How to Conduct Competitor Analysis for UK Business

Conducting a proper competitor analysis isn't just a box-ticking exercise. It's about getting under the skin of your rivals—figuring out their strategies from pricing and products to their marketing playbook. You then use that intelligence to spot gaps in the market and make sharper decisions for your own business. Think of it as the foundational work for building a brand that can actually compete not just exist.

Why Competitor Analysis Fuels UK Business Growth

Let's be blunt: the UK market is crowded and fiercely competitive. Having a great product or service is the bare minimum. If you don't know what your competitors are doing well, where they're falling short and what they're planning next you're flying blind. It’s not just a nice-to-have; it's essential for survival.

This process turns a dusty one-off report into a live feed of strategic insight. It’s about cultivating a deep awareness of your commercial environment which directly impacts your ability to win new customers, build a stronger brand and ultimately grow your revenue.

Find and Fill Gaps in the Market

One of the most valuable things you'll get from a solid competitor analysis is spotting what customers want but aren't getting. By digging into your competitors' products and more importantly what their customers are complaining about you can pinpoint service gaps or missing features.

Imagine a local artisan coffee shop in Manchester notices its main rival gets consistently bad reviews for its tiny selection of vegan pastries. That's not just feedback; it's a golden opportunity. By launching a fantastic range of plant-based treats the shop can pull in an entire customer segment that's being ignored. This is how you stop battling on price alone and start competing on real value, a vital tactic to stand out in a competitive market in 2025.

When you systematically look at your competition you're not just collecting data—you're collecting opportunities. Every weakness you uncover in their approach is a potential strength for yours.

This mindset shift helps you make proactive informed decisions instead of just reacting when a competitor makes a move. It puts you in the driver's seat.

Sharpen Your Unique Value Proposition

You can't know what makes you special until you know what everyone else is doing. Understanding how your rivals position their brand, the language they use and who they're trying to sell to is crucial for carving out your own unique space in the market.

A good analysis will tell you if your competitors are hanging their hats on:

- Price: Are they the go-to budget option?

- Quality: Do they sell themselves as the premium top-shelf choice?

- Convenience: Is their main draw how easy or fast they are?

- Customer Service: Is exceptional support their claim to fame?

Once you have this map you can fine-tune your own messaging to shout about what you do best. If everyone else is in a race to the bottom on price maybe it's time to double down on your superior quality or incredible customer service.

Drive Smarter Marketing and SEO Efforts

Here in the UK savvy businesses are baking competitor analysis right into their digital marketing plans. According to the UK State of Digital Marketing Report a significant 22% of businesses now directly integrate competitor insights into their SEO work. And with 36% naming lead generation as their biggest priority you can see why this intelligence is so critical for finding new growth channels. You can dive into the full UK digital marketing report for more on this.

When you know which keywords your competitors are ranking for, what kind of content gets them traction and which social media platforms are their engagement hotspots you can build a much more effective strategy from day one. It helps you skip the expensive trial-and-error phase and focus your budget on tactics already proven to work in your niche.

How to Identify Your True Competitors

Before you start pulling data you have to be absolutely sure you’re looking at the right businesses. It’s a classic mistake to fixate on the most obvious rival down the road or the big brand that always pops up in search results. The truth is your competitive field is much wider and more complex.

Getting this wrong means you're working with an incomplete picture which can lead to some painful strategic blind spots later on.

The trick is to think beyond the usual suspects. You need a practical way to map out everyone who’s fighting for your customer’s attention and money. That means looking at direct rivals, indirect players and even those emerging companies that could shake things up in the future.

Look Beyond Direct Rivals

First things first let’s get clear on the different types of competitors out there. Most business owners have a solid grip on their direct competition but the others often get ignored.

-

Direct Competitors: These are the ones you probably already know. They offer the same or a very similar product or service to your exact audience. If you run a high-end Italian restaurant in Bristol other fancy Italian places in the city are your direct competition. Simple.

-

Indirect Competitors: This is where it gets interesting. These businesses solve the same core problem for your customers just with a different solution. For that Italian restaurant an upmarket Thai eatery or a premium meal-kit delivery service like Gousto are indirect competitors. They all answer the "what's for a special dinner tonight?" question.

-

Tertiary or Replacement Competitors: This group is even broader. They offer something completely different but are still vying for the same slice of your customer's budget. For instance a customer might choose to spend their disposable income on theatre tickets instead of a lavish meal out.

Realising these different categories exist is a huge step. Ignoring the indirect and tertiary players is a common misstep that leaves you vulnerable to market shifts you just won’t see coming.

Uncovering Competitors with Keyword Research

One of the best ways to find your digital competitors is to put yourself in your customer’s shoes. What words would they actually type into Google? Start by brainstorming a list of keywords and phrases related to what you sell.

Let’s say you’re a UK-based company selling sustainable pet food. You might search for:

- "eco-friendly dog food UK"

- "best organic cat food"

- "grain-free pet food subscription"

Run these searches and take note of who consistently shows up on the first page. These are your SERP (Search Engine Results Page) competitors . Look at who’s ranking in the normal organic results and who’s paying for ads. This shows you who is actively spending money to get in front of your ideal customer. It's a quick and dirty way to build a solid list of rivals to watch.

Remember, your biggest competitor might not be who you think it is. It's whoever your customer considers an alternative. SEO tools can reveal competitors you never knew you had simply because they are winning the keyword battles that matter most.

Categorise and Prioritise Your List

Once you've got a long list of names you need to bring some order to the chaos. Trying to track fifty businesses at once is a recipe for disaster. Not every competitor deserves the same level of attention.

The next logical move is to sort them into tiers.

A simple tier system helps you focus your energy where it'll make the biggest difference:

- Tier 1 (Primary Competitors): These are your direct competitors, the ones who are performing well and chasing the exact same customers you are. You need to be watching these businesses like a hawk ideally on a regular basis.

- Tier 2 (Secondary Competitors): This bucket holds direct competitors who might be smaller or less successful plus your stronger indirect competitors. A quarterly check-in is probably enough for this group.

- Tier 3 (Emerging Competitors): Think of these as the up-and-comers. They might be new to the market or tertiary players that could become a threat down the line. Keep an eye on them but they don’t need a deep-dive analysis just yet.

This tiered approach turns competitor analysis from an overwhelming chore into a structured strategic process. It ensures your efforts are targeted, efficient and actually useful for your business.

Gathering Actionable Competitive Intelligence

Right, you’ve identified your key competitors. Now the real detective work begins. This isn’t about drowning in spreadsheets filled with vanity metrics. The goal here is to gather targeted intelligence that will actually shape your strategy giving you a crystal-clear picture of your competitors' strengths, weaknesses and their overall game plan.

We're going to break down exactly what to look for and where to find it. This means doing a deep-dive into their website and search performance, carefully deconstructing their content and social media presence and taking an honest look at their pricing and what real customers are saying about them.

Analysing a Competitor's Website and SEO Performance

Think of a competitor's website as their digital storefront—it's an absolute goldmine of information. Your first job is to figure out how they attract visitors and what they want those visitors to do once they arrive. To do this properly you need to know how to perform a comprehensive SEO competitor analysis.

Start with their main pages. What’s the core message on their homepage? Which products or services are they pushing front and centre? This gives you an immediate feel for their priorities. From there it's time to bring in the heavy hitters. Tools like Ahrefs or Semrush are indispensable for digging into the nuts and bolts of their SEO strategy.

With these tools you can uncover some critical data points:

- Top Organic Keywords: Which search terms are bringing them the most traffic? This tells you exactly what their audience is looking for and which keywords hold the most value in your market.

- Backlink Profile: Who is linking to them? High-quality backlinks from reputable sites are a huge sign of authority. Analysing these can uncover potential partnership or PR opportunities you might have missed.

- Top Performing Content: Which of their blog posts or pages attract the most links and search traffic? This is basically a blueprint showing you the topics and formats that really connect with your shared audience.

If you need a refresher on how search engine optimisation drives visibility it’s worth checking out our comprehensive guide to boosting your online visibility.

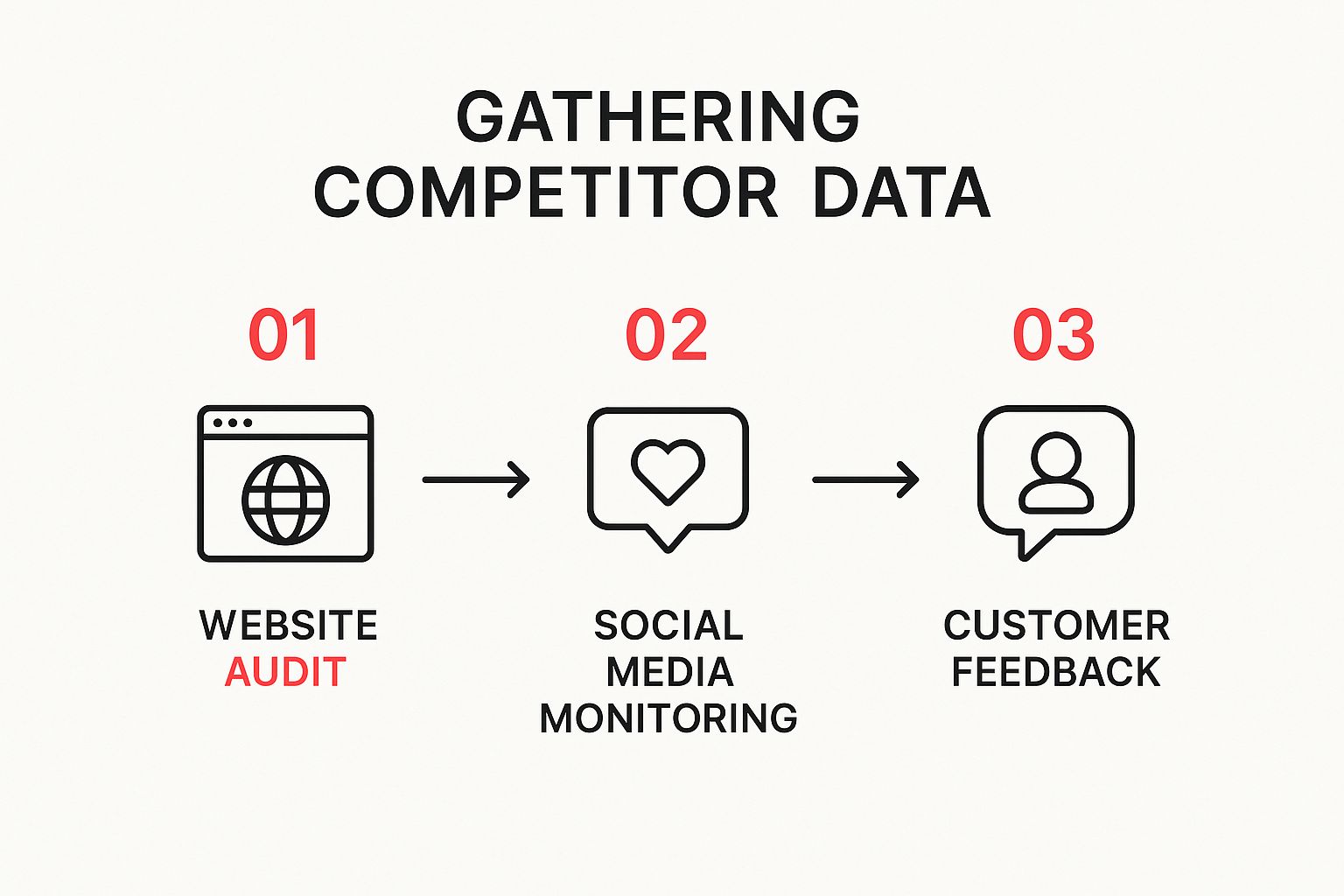

This initial data gathering follows a pretty logical path starting from their core digital asset and working outwards as this infographic illustrates.

As you can see the path is clear: start with a technical audit of their website, then move on to their public-facing social channels and finish by assessing direct customer feedback.

To get the job done right you'll need a few tools in your arsenal. There's a wide range out there each with its own speciality.

Essential Tools for Competitor Analysis

| Tool Category | Example Tools | Primary Use Case |

|---|---|---|

| SEO & Keywords | Ahrefs, Semrush, Moz | Analysing organic traffic, keywords and backlink profiles. |

| Social Media Listening | Brand24, Mention, Hootsuite | Monitoring brand mentions, engagement and social sentiment. |

| Content Analysis | BuzzSumo, Similarweb | Identifying top-performing content and traffic sources. |

| Customer Reviews | Trustpilot, G2, Google Reviews | Gathering direct customer feedback, complaints and praise. |

Choosing the right mix of tools depends on your specific goals but a combination of an SEO platform and a social listening tool is a fantastic starting point for most businesses.

Deconstructing Content and Social Media Strategy

A competitor’s content and social media activity is a window into how they communicate with their audience. It's not just about what they post but the story they’re trying to tell about their brand.

Take a good look at their blog, their YouTube channel and their main social media profiles. You need to ask yourself a few key questions to really understand their approach.

- What’s their tone of voice? Are they buttoned-up and corporate or are they more casual and humorous?

- Which platforms do they prioritise? A heavy presence on LinkedIn almost certainly suggests a B2B focus whereas a vibrant TikTok profile points towards a younger consumer-facing audience.

- What content formats do they lean on? Are they all-in on video or do they prefer long-form articles, infographics or quick-hit social posts?

- How’s their engagement? Look past the follower counts. Are people actually commenting, sharing and reacting to their posts? High engagement on certain topics is a massive signal of what the audience truly cares about.

A competitor's social media feed is basically a public focus group. The posts that get the most traction are a direct reflection of your target market's interests, pain points and preferences.

By methodically analysing this you can spot the gaps. If all your competitors are ignoring video but you know your audience loves it that’s a clear opportunity. Likewise if their content is purely promotional you can swoop in and win people over by providing genuinely helpful educational material instead.

Examining Pricing and Customer Reviews

Finally you have to get to grips with their offer and crucially how it’s perceived by the market. This means looking at their pricing structure and digging into what their customers are really saying.

Pricing is never just a number; it’s a powerful message about value. Go through their website and document their pricing tiers, what’s included in each one and any discounts they're promoting. Is their model a one-off purchase, a monthly subscription or something more complex?

Once you have a handle on their pricing it’s time to head to third-party review sites like Trustpilot , Google Reviews or industry-specific forums. This is where you find the unvarnished truth. Don't just glance at the star rating—read the actual comments.

Keep a sharp eye out for recurring themes:

- Praised features: What do customers consistently love? What makes them happy they chose that company?

- Common complaints: What are the recurring frustrations? Is it the customer service, the product quality or hidden fees?

- Language used by customers: How do they describe the product and the problems it solves for them? This is pure gold for refining your own marketing copy.

A steady stream of complaints about a competitor's slow delivery for example is an incredibly powerful insight. It reveals a specific weakness you can target in your own marketing and operations by highlighting your fast reliable service. This is how you turn raw data into a genuine competitive advantage.

Turning Competitor Data Into Opportunities

So you’ve gathered a mountain of data. The spreadsheets are full, the reports are downloaded but information on its own is pretty useless. The real magic happens when you start connecting the dots and turn those raw facts into a genuine strategic roadmap. This is where you shift from just observing to actually interpreting, uncovering the competitive edge that’s been hiding in plain sight.

It’s all about spotting the patterns in what your rivals are doing, pinpointing where they're weak and finding those crucial gaps in the market. The goal is to stop simply knowing what they’re up to and start understanding why they’re doing it—and more importantly how you can do it better.

Using SWOT to Frame Your Analysis

One of the best ways I've found to make sense of all this information is to run it through a classic SWOT analysis framework. You've probably used it for your own business but it's incredibly powerful when you turn it outwards to assess your competitors. For each major rival you’ll want to organise your findings into these four buckets.

This simple structure forces you to look at the data from different angles making it much easier to see how you stack up against them.

- Strengths: What are they genuinely brilliant at? Maybe it’s their bulletproof brand recognition, their website's flawless user experience or a fiercely loyal customer base.

- Weaknesses: Where are they dropping the ball? This could be anything from a string of poor customer reviews and an outdated website to a non-existent social media presence.

- Opportunities: Based on their weaknesses where are the market gaps? What trends are they completely missing that you could swoop in and own?

- Threats: What are they doing that could seriously hurt your business? Think aggressive new pricing, a major product launch or a clever marketing campaign.

Going through this process helps you move beyond a simple list of facts and start building a narrative about each competitor’s place in the market.

When you're digging into a competitor's business your main goal should be to find a weakness you can turn into your strength. Every negative Trustpilot review they get is a marketing opportunity for you.

This mindset is crucial. You’re not just documenting their business; you’re actively hunting for the chinks in their armour.

Identifying Patterns and Market Gaps

Once your data is neatly organised the bigger picture starts to emerge. Do all your competitors target the exact same customer demographic with nearly identical messaging? That’s not a coincidence; it’s a pattern revealing a very crowded space.

More importantly it highlights who they aren't talking to. This is where the real market gaps live.

Let's imagine you run a local web development agency in Devon. Your analysis shows that your three main rivals all focus on high-end bespoke websites for established corporations. Their marketing is slick and corporate and their pricing is just as premium.

At first glance that might seem intimidating. But it actually reveals a huge opportunity. There’s likely an entire segment of start-ups and small businesses in the area being completely ignored. They need professional websites but can’t justify those hefty agency fees. Suddenly you can position your agency as the go-to, affordable and friendly choice for emerging businesses. This isn’t just a gut feeling; it’s a strategic opportunity uncovered directly by the data.

Navigating Economic Headwinds

In the current UK business climate this kind of strategic insight is more critical than ever. UK businesses are grappling with ongoing market uncertainties which makes a solid competitor analysis non-negotiable. The Office for National Statistics' Business Insights report found that nearly two-thirds ( 65% ) of UK businesses felt some level of concern about the future. Their biggest worries? Falling demand ( 18% ) and taxation pressures ( 15% ).

By analysing how your competitors are navigating these very same challenges you can learn from their successes and failures in real-time. This allows you to adapt your own pricing, innovation and customer retention tactics to stay one step ahead. You can learn more about how UK businesses are feeling in the latest ONS report.

From Insights to Actionable Ideas

The final—and most important—step is to translate these opportunities into concrete actions. For every weakness or gap you've identified you need to brainstorm a specific tactic your business can implement.

Here's how this might look in practice:

-

Insight: You discover your main competitor's social media content is bland and gets almost no engagement.

- Action: Launch a more dynamic social media campaign. Focus on video and interactive content especially on the platforms they're neglecting.

-

Insight: Customer reviews repeatedly mention a rival’s slow and unhelpful customer support.

- Action: Make exceptional customer service your key selling point. Shout about your fast response times and dedicated support team in all your marketing.

-

Insight: Your competitors rank well for broad high-level keywords but completely ignore more specific long-tail search terms.

- Action: Build a content strategy laser-focused on these niche high-intent keywords to capture qualified traffic they are missing out on.

This systematic approach ensures your competitor analysis doesn't just end up in a forgotten folder. It becomes a living document that directly informs your marketing, product development and overall business strategy giving you a clear path to growth.

Putting Your Competitor Insights Into Action

Let's be honest: an analysis is only valuable if it actually leads to change. All the time you've spent gathering data and spotting trends means very little unless you turn it into a concrete game plan. This is where we move from insight to impact ensuring your hard work doesn't just become another report left to gather dust.

The trick is to present your findings in a way that’s clear, compelling and impossible for stakeholders to ignore. It’s about telling a story with your data and then building a roadmap that spells out exactly what needs to happen next.

Creating a Clear and Persuasive Report

Before you can build a plan you need to get your findings in order. Forget about those sprawling fifty-page documents that nobody has time to read. Your goal is a concise, visual and powerful summary. A simple competitor scorecard is often the most effective tool for this.

For each key competitor you've looked at break it down like this:

- Main Strengths: What are the one or two things they do exceptionally well?

- Critical Weaknesses: Pinpoint their most significant vulnerabilities you’ve found.

- Key Strategic Opportunity: Define the single biggest opening their weaknesses create for your business.

- Urgency Score: Give it a simple 1-5 rating on how quickly you need to act on this information.

This format cuts straight to the point and focuses everyone’s attention on what really matters.

When you present to stakeholders let the numbers do the talking. Using hard data makes your case undeniable. For instance in 2024 Shell’s revenue hit £284.31 billion while BP's was £189.18 billion —a 64% difference. Metrics like these provide crucial context on business scale and market dominance. Presenting clear quantitative comparisons is how you make a compelling case for a strategic shift.

Building Your Actionable Roadmap

With your findings neatly summarised it's time to build your roadmap. This is where you decide which opportunities to chase. Not all ideas are created equal so you need a smart way to prioritise.

One of the most powerful methods I've used is the impact versus effort matrix . It’s a simple two-by-two grid where you plot each potential action.

| Low Effort | High Effort | |

|---|---|---|

| High Impact | Quick Wins (Do these now) | Major Projects (Plan carefully) |

| Low Impact | Fill-ins (Consider if time allows) | Time Sinks (Avoid these) |

This visual tool immediately shows you where to focus your resources for the biggest bang for your buck. Those "Quick Wins" are your top priority—they deliver significant results without draining your team or your budget. If you want to get more systematic about this it's worth learning how to build a comprehensive competitive analysis framework.

Assigning Ownership and Measuring Success

An idea without an owner is just a nice thought. Once you’ve prioritised your initiatives the next critical step is assigning clear ownership. Who specifically is responsible for launching that new social media campaign? Who will oversee the update to your customer service charter?

A plan is just a wish until it's assigned. Clear ownership and defined metrics are the bridges between your competitor analysis and actual business growth.

Alongside ownership you must define what success actually looks like. That means setting clear Key Performance Indicators (KPIs) for every single initiative. This is a non-negotiable part of https://www.superhub.biz/harnessing-the-power-of-data-driven-marketing-strategies-for-success.

Here are a couple of real-world examples:

- For an SEO initiative: The KPI might be to achieve a top-three ranking for five specific long-tail keywords within six months.

- For a customer service push: The KPI could be to improve your Trustpilot score from 4.2 to 4.6 within one quarter.

By tying every action back to a measurable outcome you create accountability. This transforms your competitor analysis from a one-off project into a continuous cycle of improvement that drives tangible growth.

Common Competitor Analysis Questions

Even with a perfect plan you're bound to hit a few snags or have questions pop up once you get stuck into the real work of competitor analysis. That’s perfectly normal.

To help you get past those common sticking points I’ve put together answers to some of the most frequent questions we hear from businesses just starting out. Think of this as a quick troubleshooting guide to keep you on the right track.

How Often Should I Conduct a Competitor Analysis?

This is the big one and the honest answer is: it depends. There’s no single rule that works for everyone.

As a solid rule of thumb aim for a really deep comprehensive analysis annually or biannually . This is your chance to do a full strategic review, re-evaluate who your main competitors are and take a good hard look at their entire operation.

But you can't just set it and forget it. For the faster-moving parts of their business—like social media campaigns, flash sales or new blog posts—a quarterly or even monthly check-in is vital. This keeps you from being caught off guard by a sudden tactical shift.

Think of competitor analysis less like a one-off project and more like a continuous habit. The annual deep-dive sets your baseline while regular monitoring keeps your strategy agile and responsive to market changes.

If you’re in a particularly fast-paced industry like e-commerce or tech you’ll want to lean towards more frequent check-ins. A simple trick is to set up a few Google Alerts for your competitors’ brand names. It automates the monitoring and does the heavy lifting for you.

What Are the Most Common Mistakes to Avoid?

I’ve seen it time and time again: companies invest hours into analysis only to have it fall flat. Knowing what not to do is just as important as knowing what to do.

Being aware of these common traps is the first step to sidestepping them entirely. Here are the biggest blunders people make:

- Diving in without a goal: Don't just start grabbing data. You need to have specific questions you want to answer before you begin. Otherwise you’ll drown in a sea of information with no clue what it all means.

- Focusing only on direct competitors: This is a huge blind spot. The next major threat might come from an indirect competitor who solves the same customer problem in a completely different way. Always keep an eye on the fringes.

- Getting 'analysis paralysis': It's so easy to get bogged down in collecting data that you never actually get around to interpreting it. Set a clear deadline for your research phase then force yourself to move on to finding actionable insights.

- Playing copycat: Your goal is to understand what your rivals are doing so you can find your own unique angle not to imitate them . Use what you learn to innovate and stand out not become a watered-down version of someone else.

How Do I Analyse Competitors With a Limited Budget?

You absolutely do not need a massive budget or a library of expensive software to do this well. While premium tools are nice to have a well-organised manual approach can give a small business more than enough intelligence to make smart decisions.

Plenty of powerful resources are completely free. Start by using an incognito browser window to Google your main keywords. This shows you how competitors rank without your own search history clouding the results. Spend some time manually scrolling through their social media feeds to get a feel for their tone, content and how people are reacting to them.

Here’s another great tip: sign up for their email newsletters. This is a brilliant behind-the-scenes look at their sales tactics, messaging and marketing funnels. You get to see their customer journey firsthand exactly as a potential lead would. It’s a simple but incredibly revealing tactic that costs you nothing.

Ready to turn competitor insights into real growth? The team at Superhub specialises in creating data-driven marketing strategies that give you a genuine competitive edge. Contact us today to find out how we can help your brand thrive.

Want This Done For You?

SuperHub helps UK brands with video, content, SEO and social media that actually drives revenue. No vanity metrics. No bullshit.