How content marketing for financial services boosts trust

Content marketing in financial services is not about the hard sell. It is the strategic art of creating and sharing genuinely valuable, relevant content to attract and keep clients. In a sector where trust is everything, this approach shifts the focus from pitching products to educating and empowering people. It is about turning complex financial jargon into clear, understandable insights that build real, long-term loyalty.

Why Content Marketing Is Essential in Financial Services

In an industry built on credibility, content marketing has gone from a ‘nice-to-have’ to the main engine for building trust. Let us face it, traditional advertising often falls flat when trying to convey the deep expertise required to manage someone's financial future. Content, on the other hand, is the perfect stage to demonstrate your knowledge and build confidence.

Think of your content as the digital version of a trusted adviser offering sound guidance. Instead of a sales pitch, you are providing a helpful article on navigating market volatility or a straightforward guide to understanding pension options. This approach completely changes the dynamic, moving the client relationship from transactional to advisory.

Bridging the Gap Between Complexity and Clarity

Financial products are, by their very nature, complicated. This makes clients cautious, sometimes even sceptical. Your content acts as a bridge, translating industry speak into practical, real-world advice they can actually use.

By consistently offering value without immediately asking for something in return, you cement your brand as a go-to, reliable resource. This educational approach helps you hit several key goals essential for growth in the financial world:

- Demonstrates Expertise: High-quality articles, white papers and webinars are your chance to showcase your firm’s deep understanding of the market.

- Builds Lasting Trust: In finance, trust is the most valuable currency. Transparency and a genuine desire to help are the cornerstones of building it.

- Addresses Client Pain Points: Your content can directly answer the burning questions your clients have about their investments, savings and financial planning.

The core purpose of content marketing for financial services is to replace uncertainty with confidence. By educating your audience, you empower them to make better financial decisions, establishing your firm as an indispensable partner in their journey.

Adapting to Modern Client Expectations

Client behaviour has fundamentally changed. Today's investors and consumers do their homework online long before they ever think about picking up the phone to an adviser. A strong content strategy makes sure you are there, being helpful, during this crucial discovery phase.

This is especially true for younger demographics. It is no surprise that financial services firms have ramped up their investment in video, producing 41% more video explainers in 2025 to connect with millennial and Gen Z investors.

Ultimately, an effective content strategy does more than just bring in leads; it builds genuine authority. To explore this further, you might be interested in our guide on the role of content marketing in building brand authority.

Decoding Your Financial Services Audience

Truly effective content marketing in financial services starts with a deep, almost forensic, understanding of who you are talking to. It is a common mistake to paint audiences with a broad brush based on simple demographics like age and income but to create content that genuinely connects, you have to dig deeper into the psychographics—the fears, aspirations and knowledge gaps that actually drive financial decisions.

What is keeping your potential clients awake at night? Is it the dream of getting on the property ladder, the anxiety of an unplanned retirement or the pressure of funding a growing business? Answering these questions lets you move from generic advice to providing specific, valuable solutions long before a product is ever mentioned.

Moving Beyond Demographics to Personas

The key to unlocking this deeper understanding is creating detailed client personas. These are not just sterile customer profiles; they are semi-fictional representations of your ideal clients, complete with names, goals, challenges and the specific questions they are likely asking Google.

By building these personas, your content strategy gets a powerful focus. Instead of writing for a faceless crowd, you are writing for ‘Sarah’, the aspiring first-home buyer, or ‘David’, the conscientious retirement planner. This simple shift in perspective is transformative.

Building detailed personas is like getting a cheat sheet for your client's mind. It tells you not just who they are but what they need to hear from you and when they need to hear it.

This allows you to create content that feels personal and directly addresses their specific stage of the financial journey. Your content becomes a conversation, not a broadcast.

Building Your Key Financial Personas

To get started, let us explore three common personas within the financial services space. Think of these as a framework you can adapt for your own firm, whether you specialise in wealth management, insurance or business loans.

- ‘The Aspiring First-Home Buyer’ (Amelia, 29): Amelia is tech-savvy but financially cautious. Her biggest fear is being priced out of the property market for good. She is actively searching for clear information on saving for a deposit, understanding different mortgage types and navigating government schemes like LISAs. Her content needs are practical, jargon-free and reassuring.

- ‘The Conscientious Retirement Planner’ (Mark, 52): Mark is diligent and has been saving for years but market volatility makes him nervous. He worries about outliving his savings and wants to understand how to make his pension pot work harder without taking on excessive risk. He responds well to in-depth guides, webinars on market trends and case studies from people in a similar boat.

- ‘The Scale-Up Entrepreneur’ (Chloe, 38): Chloe’s business is growing quickly but cash flow is a constant headache. She needs to get her head around complex topics like venture capital, commercial loans and tax-efficient investing. Her time is incredibly limited, so she values concise, actionable content like checklists, short expert-led videos and podcasts she can listen to on the move.

By mapping out these personas, your content calendar practically writes itself. You know precisely what topics will grab their attention because you understand the real-world problems they are trying to solve.

This deep empathy is the foundation upon which a successful and trustworthy content marketing for financial services strategy is built. It ensures every single piece of content you produce has a clear purpose and a specific person it is designed to help.

Developing Your Core Content Pillars

Once you have a sharp, clear picture of your ideal client, it is time to translate those insights into an actual content plan. This is where core content pillars come in.

Think of them as the main structural supports for your entire content marketing strategy. They anchor everything you create to what your audience genuinely needs and what your business is trying to achieve.

Instead of chasing random topics or jumping on fleeting trends, content pillars give you a strategic framework. They are the broad, essential themes your brand will own, consistently and authoritatively. For a financial services firm, these are not just topics; they are commitments to educating your audience on the subjects that matter most to their financial wellbeing.

This approach ensures every article, video or webinar contributes to a larger, coherent story. It methodically builds your authority and turns your content library into a genuinely valuable resource, not just a collection of disconnected posts.

Identifying Your Strategic Pillars

Your pillars should sit squarely at the intersection of your firm's expertise and your audience's most pressing questions. They are the big-picture problems your client personas are trying to solve day in and day out. For some great, practical insights on how to structure this, check out these 12 Powerful Examples of a Content Marketing Strategy for Insurance Businesses.

Here are a few powerful examples of content pillars that are a perfect fit for the financial services sector:

- Retirement Readiness: This pillar covers everything from pension consolidation and SIPPs to navigating annuities and planning for long-term care. It speaks directly to individuals like ‘Mark the Conscientious Planner’, offering them security and clarity for the future.

- Investment Literacy: A crucial pillar for demystifying the often-intimidating world of investing. Content here could break down risk, explain ethical investing (ESG) or offer beginner guides to stocks and shares ISAs, building confidence among newer investors.

- Navigating Market Volatility: This pillar positions your firm as a calm, authoritative voice during uncertain times. It involves creating timely content that explains market movements, offers historical context and provides strategies for protecting wealth when things get turbulent.

By defining just three to five core pillars, you create a sustainable blueprint for your content calendar that constantly reinforces your expertise.

Matching Content Formats to Your Pillars

With your pillars established, the next job is to decide which content formats will bring them to life most effectively. The format should always match the topic's complexity and your audience's habits. A complex subject like inheritance tax planning, for instance, needs a more detailed format than a quick update on interest rates.

The most successful content marketing in finance does not just provide the right answers; it delivers them in the right format at the right time. The right format makes complex information feel accessible and engaging.

Thinking strategically about format ensures your message actually connects. Someone might prefer reading an in-depth report, while another will only engage with a short, explanatory video. This table can help guide your decisions.

Choosing the Right Content Format for Your Financial Audience

Picking the right format is key to making your content stick. This table breaks down which formats work best depending on your goal, where your audience is in their journey and how complex the topic is.

| Content Format | Primary Goal | Best For Audience Stage | Topic Complexity |

|---|---|---|---|

| Blog Posts & Articles | Build SEO authority and answer specific client questions | Awareness & Consideration | Low to Medium |

| In-depth Guides & White Papers | Generate high-quality leads and showcase deep expertise | Consideration & Decision | High |

| Webinars & Live Q&As | Engage prospects directly and demonstrate expertise in real time | Consideration & Decision | Medium to High |

| Short-Form Video & Infographics | Increase brand visibility and simplify complex ideas | Awareness | Low to Medium |

| Email Newsletters | Nurture existing leads and maintain client relationships | Loyalty & Retention | Low to Medium |

Ultimately, a strong content pillar is supported by a mix of formats, not just one. Your "Retirement Readiness" pillar, for example, could be brought to life through a series of blog posts on pension basics, a downloadable guide to estate planning and a live webinar with a retirement specialist.

This multi-format approach ensures you meet your audience wherever they are, ready to help them take the next step in their financial journey.

Creating Compelling and Compliant Content

In the world of financial services, the content marketing rulebook is different. Unlike other sectors where creativity can run wild, our industry operates within a tight framework of regulations. But this is not a barrier to entry; it is the very foundation of trust. The real challenge—and opportunity—is to create content that is both engaging and completely compliant.

This requires a mental shift. Do not see compliance as the final hurdle your content has to clear before it goes live. Instead, bake it into your creative process from day one. Transparency and accuracy are not just legal requirements; they are powerful marketing tools that build the deep-seated trust clients need before they will even consider handing over their finances.

To successfully merge creativity with compliance, you need a robust internal process. This is the only way to ensure every single piece of content is compelling, accurate, fair and crystal clear.

Building a Bulletproof Internal Review Process

What is the most common bottleneck in financial content creation? The final compliance review. Marketing teams spend weeks, sometimes months, crafting what they think is the perfect piece, only for it to be drowned in red ink or rejected outright by the legal team. The result is frustration, delays and a lot of wasted effort.

The solution is simpler than you think: involve your compliance and legal experts from the very beginning, not just at the end of the line.

This simple change transforms the entire dynamic from adversarial to collaborative. When your legal eagles understand the marketing goals and audience needs from the start, they can offer proactive guidance that shapes the content constructively, rather than just policing it reactively. It is a workflow that saves an incredible amount of time and gets everyone pulling in the same direction.

Compliance is not the department of ‘no’. It is the department of ‘know’—as in, knowing how to communicate your value safely and effectively within the rules. Bring them in early and they become a strategic partner in your success.

Key Principles for Compliant Content

To empower your team and speed up the review process, everyone needs to grasp the core principles of financial promotions. A game-changer here is creating a simple checklist that writers and marketers can use to self-audit their work before it even hits the compliance queue. This checklist should focus on steering clear of common pitfalls.

- Avoid Promissory Language: You can never, ever guarantee returns or promise specific outcomes. Language needs to be carefully balanced, striking words like "guaranteed", "risk-free" or "certain" from your vocabulary. Focus instead on potential outcomes and always, always include clear risk warnings.

- Substantiate Every Claim: Any statistic, fact or performance figure must be accurate, up-to-date and from a source you can verify. If you claim a fund has outperformed the market, you must be ready to prove it, clearly and fairly.

- Use Clear and Prominent Disclaimers: Disclaimers are not small print to be tucked away in a corner. They must be clearly visible and easy to understand, spelling out the risks tied to an investment or product.

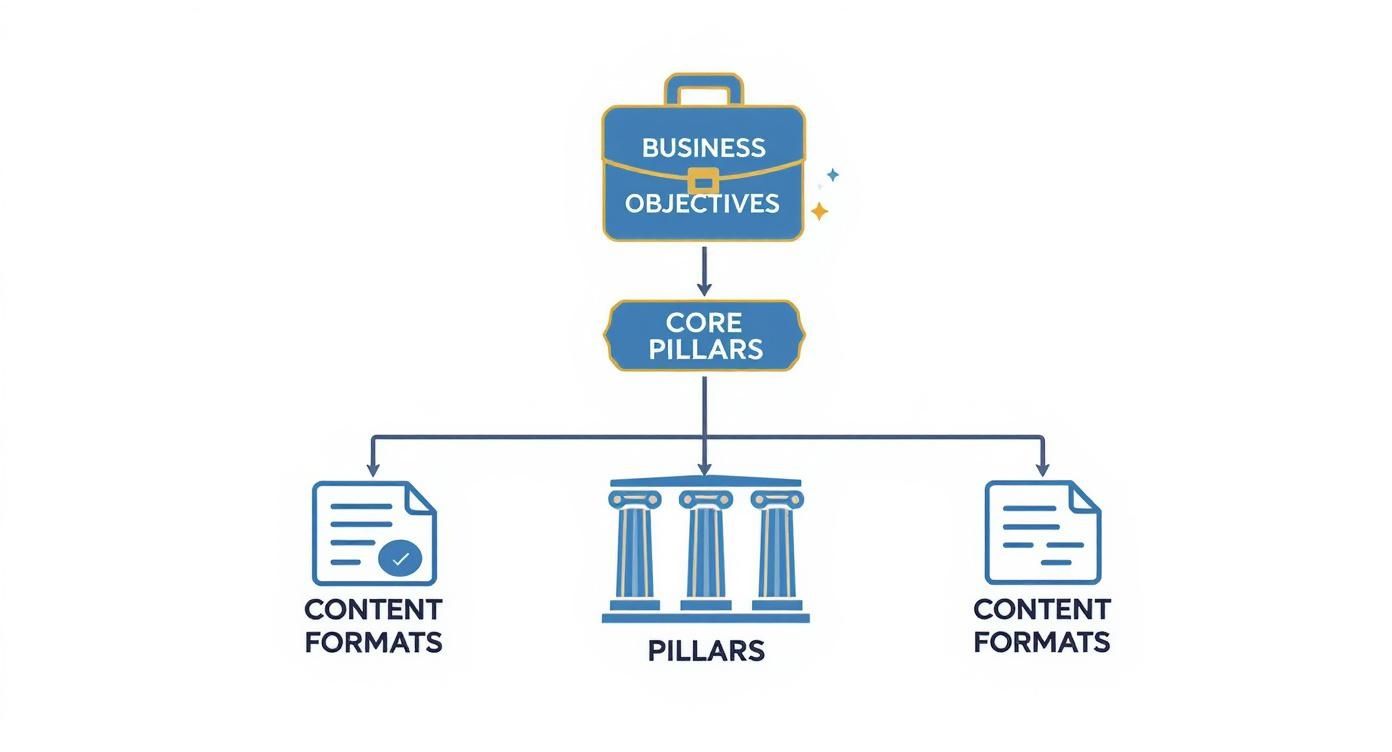

This hierarchy diagram shows how your business objectives should flow down through core pillars and into the specific content formats you create.

This visualisation drives home the point that every blog post, video or white paper must directly support a core pillar that, in turn, is aligned with your overarching business goals.

Reframing Compliance as a Trust Signal

Ultimately, creating compelling and compliant content comes down to a shift in mindset. Think of every regulatory requirement as a chance to show your firm’s integrity and commitment to your clients' wellbeing. When you are transparent about risks, clear about fees and honest about potential performance, you are not just ticking a compliance box—you are actively building trust.

This approach turns regulatory chains into a competitive advantage. In a market where clients are rightly sceptical, a brand that communicates with total honesty and clarity stands out. Your dedication to compliance becomes a powerful message. It tells potential clients that you put their financial security above all else, making your content marketing for financial services not just effective but fundamentally trustworthy.

Amplifying Your Content with SEO and Distribution

Creating exceptional, compliant content is a huge achievement but it is only half the battle. The most insightful article or helpful video is useless if nobody sees it.

This is where a deliberate amplification strategy comes in. It is the difference between having a quiet library of assets and having a powerful engine that attracts new clients and keeps existing ones engaged.

The process has two sides. First, Search Engine Optimisation (SEO) makes your content discoverable the moment a potential client is looking for answers. Second, strategic distribution pushes your content out across the right channels to meet people where they already are. Getting this combination right is what maximises the return on every piece of content marketing for financial services you produce.

The Foundations of Financial SEO

In finance, SEO is not just about chasing keywords; it is about building digital authority. When people search for financial advice, they are not just looking for information—they are looking for trustworthy, expert answers.

Thankfully, Google’s algorithms are designed to reward exactly that. This is why optimising for E-E-A-T is non-negotiable.

E-E-A-T stands for Experience, Expertise, Authoritativeness and Trustworthiness . For financial firms, this is not a hurdle; it is a huge advantage. Your inherent expertise is a powerful SEO asset just waiting to be shown.

Here is how to put E-E-A-T into practice:

- Showcase Your Expertise: Ensure articles are written by qualified professionals. Include clear author biographies that highlight their credentials and real-world experience.

- Demonstrate First-Hand Experience: Talk about real client scenarios (anonymised, of course) or case studies. Show that you have actually guided people through the very problems you are discussing.

- Build Authority: Get mentions or links from reputable financial publications. Make sure your firm’s profiles on professional sites are up-to-date and consistent.

- Earn Trust: Make your contact information easy to find, display client testimonials prominently and ensure your website is secure.

In the world of financial SEO, E-E-A-T is not a tactic; it is your business model made visible. It is about proving to search engines what your clients already know—that you are a credible, reliable and expert source of guidance.

Keyword research is the other cornerstone. You need to get inside your clients' heads and target the specific phrases they are typing into Google. Think beyond broad terms and focus on long-tail keywords that reveal real intent, like 'how to start a SIPP for self-employed' or 'best ethical investment funds UK'. These queries show someone is actively seeking a solution you can provide.

For a deeper dive into this area, you can learn more by unlocking the power of SEO with our comprehensive guide to boosting your online visibility.

Building Your Multi-Channel Distribution Engine

SEO is a brilliant 'pull' strategy but you also need a 'push' strategy to actively place your content in front of the right audience. If you rely on search alone, you will miss out on countless opportunities to nurture leads and strengthen client relationships.

A multi-channel distribution plan makes your content work much harder. The key is not to be everywhere but to be everywhere that matters to your target audience.

Effective Distribution Channels for Finance

- LinkedIn: This is the premier platform for financial services, hands down. It is ideal for sharing thought leadership articles, market analysis and company insights. It lets you target specific professional demographics and join industry conversations, cementing your firm's authority.

- Targeted Email Newsletters: Your email list is gold. Use it to share your latest content directly with a warm audience of clients and prospects. Segment your lists to send content relevant to each person’s interests—retirement planning tips for older subscribers, for example, and mortgage advice for younger ones.

- Strategic Partnerships: Team up with non-competing professionals who serve a similar clientele, like accountants or solicitors. Co-authoring a guide or co-hosting a webinar can introduce your expertise to a brand new, highly relevant audience.

By combining a robust SEO foundation with a smart distribution plan, you create a system that ensures your valuable content consistently reaches the right people. This integrated approach turns your content from a static library into a dynamic asset that builds authority, nurtures relationships and drives real business growth.

Measuring Your Content Marketing ROI

So, you have created some fantastic content. But how do you prove it is actually working?

Without a clear way to measure success, even the most creative content marketing for financial services is just a shot in the dark. It is time to move past surface-level vanity metrics like page views and focus on the numbers that show real business value.

Demonstrating a return on investment (ROI) is what turns your content from a cost centre into a recognised growth engine. It is how you justify budgets, refine your strategy and get the backing you need to build something truly effective.

Moving Beyond Vanity Metrics

It is always nice to see high traffic numbers but they do not tell the whole story. A thousand visitors who bounce immediately are far less valuable than ten who download a guide and request a consultation.

The key is to tie your metrics directly back to your original business goals. Your measurement framework should connect specific content activities to tangible business outcomes.

- For Brand Awareness: Track growth in organic search visibility for your target keywords (like ‘ethical investment funds UK’). Monitor brand mentions and see how much of the conversation you own in your niche.

- For Lead Generation: Keep an eye on the number of downloads for gated assets like white papers or eBooks. Measure the growth of your email subscriber list and the conversion rate of your content landing pages.

- For Client Acquisition: Use your analytics to track content-influenced conversions . This means figuring out how many new clients read a blog post, watched a webinar or downloaded a guide before they ever got in touch.

The most powerful KPI is the one that bridges the gap between a marketing action and business revenue. Tracking how your content directly contributes to signing a new client provides undeniable proof of its value.

Calculating Your Content ROI

Calculating ROI does not need to be a complex mathematical puzzle. At its simplest, it is about comparing the money your content brought in against what it cost to create and promote.

Attributing every new client to a single blog post can be tricky but having a clear model makes it possible. A solid plan should also fit into your wider data-driven marketing strategies for banks to ensure all your efforts are pulling in the same direction.

Here is a straightforward approach to get you started:

- Calculate Your Total Investment: Add up every cost tied to your content programme over a set period. This includes writer fees, software subscriptions and any money spent on promotion.

- Track Content-Sourced Leads: Use your analytics or CRM to identify how many new leads first found you through a piece of content.

- Determine the Value of a Lead: Work out your average lead-to-client conversion rate and the average lifetime value of a new client. This gives you a clear monetary value for each lead your content generates.

- Calculate the Return: Compare the total value generated from your content-sourced clients against your initial investment.

This process gives you a clear, defensible figure that proves the financial contribution of your content. For a more detailed breakdown, our complete UK marketer’s guide on how to measure ROI provides additional frameworks.

By consistently measuring and reporting on these metrics, you can confidently demonstrate the commercial power of your content marketing.

Got Questions? We've Got Answers

Stepping into content marketing in the financial world can bring up a lot of questions. It is a unique space with its own set of rules. Here are some of the most common ones we hear, with straight-talking answers to help you find your footing.

How Can a Small Advisory Firm Compete with the Big Banks?

Do not even try to play their game. You cannot win a battle of volume or broad keywords against the major players and you do not have to. The smartest move is to focus on a specific niche .

Own your corner of the market. Become the go-to expert for a very specific group, like freelance creatives navigating their finances or young professionals interested in ethical investing. By demonstrating deep, personalised expertise and building a strong local SEO presence, you will attract a targeted, loyal client base that the big banks simply cannot serve as well.

In finance, genuine trust and quality will always beat sheer volume. That is how you win.

What Is the Single Most Important Part of Financial Content?

It is one word: trust . No question.

Every single thing you publish, from a quick social media post to a detailed white paper, must be meticulously accurate, transparent and written with your client's best interests at heart. There are no shortcuts here.

Trust is the absolute bedrock of any financial relationship. Your content is not just a way to get leads; it is the primary way you build the credibility someone needs to hand over their financial future to you. Every word matters.

This unwavering commitment to integrity is what separates powerful content marketing from just another advert.

How Long Will It Take to See Results?

Patience is a virtue in finance and it is just as crucial in content marketing. Think of this as a long-term investment, not a get-rich-quick scheme. You might see some encouraging early signs—like better search engine rankings or more website traffic—within three to six months .

But for those early indicators to turn into real business, it takes time. You are looking at twelve months or more of consistent, high-quality work before you will see significant lead generation and a clear return on your investment. Consistency is what builds the momentum that delivers lasting results.

At Superhub , we build strategy-driven content that creates trust and delivers measurable growth for financial services firms. We have been in the industry long enough to know how to create compelling marketing that also ticks all the compliance boxes. Ready to build a content engine that actually drives results? Get in touch with us today.

Want This Done For You?

SuperHub helps UK brands with video, content, SEO and social media that actually drives revenue. No vanity metrics. No bullshit.