How to Conduct Competitor Analysis in the UK

Before you start digging into data, you need a plan.

Jumping straight into analysis without a clear framework is a recipe for disaster. You’ll end up with a mountain of random information, no clear insights, and a lot of wasted time. The first real step is to build a framework that gives your research purpose and direction.

Build Your Competitor Analysis Framework

Think of this stage as asking the right questions before you go looking for answers. What are you actually trying to achieve here? Are you hunting for gaps in the market? Trying to figure out if your pricing is right? Or do you just want to understand a rival's marketing playbook?

Without clear goals, you're just collecting trivia. A solid framework turns that trivia into a genuine strategic advantage.

Define Your Core Objectives

First things first, what does a "win" look like for this analysis? Your goals will completely shape the kind of information you need to find.

Here are a few common objectives to get you started:

- Spotting Market Opportunities: Find underserved customer needs or product features your competitors are ignoring.

- Sharpening Your Pricing and Positioning: See how your pricing stacks up and understand how your brand is actually perceived in the market.

- Strategic Benchmarking: Honestly measure your performance against the top players to identify where you're strong and where you’re lagging behind.

- Improving Marketing Effectiveness: Analyse which channels and messages are genuinely connecting with your shared target audience.

Setting these objectives ensures every piece of data you collect has a job to do. It all feeds back into your overarching digital marketing strategy. To see how these insights can shape your bigger picture, check out our deep dive on what a digital marketing strategy is.

Identify Your True Competitors

It’s easy to think you know who your competitors are, but not all rivals are created equal. To get a complete view of the market, you need to look beyond the obvious names and categorise them properly. This helps you prioritise your efforts and understand the different pressures you’re facing.

This is especially true for tech companies. A dedicated SaaS competitive analysis is vital for building a framework that gives you a real edge in a crowded market.

We can break down competitors into a few key types. Understanding each one gives you a much richer picture of the landscape you're operating in.

Identifying Your Competitors

| Competitor Type | Description | Why They Matter | Example (UK Market) |

|---|---|---|---|

| Direct Competitors | Businesses offering the same product or service to your target audience. | They are your most immediate threat and the benchmark for your performance. | For a London based artisan coffee shop, another artisan coffee shop on the next street. |

| Indirect Competitors | Businesses offering a different solution to the same problem your customers have. | They can reveal alternative ways to meet customer needs and highlight emerging trends. | For the same coffee shop, a high end tea room or a smoothie bar nearby. |

| Replacement Competitors | Businesses offering a completely different product that makes yours unnecessary. | They represent a long term threat and can signal major shifts in consumer behaviour. | For the coffee shop, a Nespresso machine or premium instant coffee brands. |

| Aspirational Competitors | Market leaders or innovators you look up to, even if they aren't direct rivals. | They provide a blueprint for excellence in marketing, branding, and customer experience. | For the local coffee shop, a globally recognised brand like Monmouth Coffee Company. |

By mapping out all these different types, you move from a simple "us vs. them" mindset to a sophisticated understanding of your market position and potential threats.

Your framework is your roadmap. It transforms a vague desire to "check on the competition" into a systematic process for generating strategic insights that can genuinely move your business forward.

And make no mistake, the pressure is on. Staying ahead is a constant challenge for UK businesses. Recent ONS data shows that competition is a major worry across the board, with 65% of UK businesses reporting some level of concern about their future. While issues like falling demand were cited most, ‘competition with other UK businesses’ was the primary concern for 8% of companies, and a massive 23% in the private education sector.

This shows that just keeping an eye on your rivals isn't enough anymore. You need a deeper, more strategic approach to truly understand the competitive landscape. You can find more on this in the ONS business survey on competition.

Gather Intelligence on Your Competitors

With your framework in place, it’s time for the real investigation to begin. This is where you dig deeper than surface level observations to figure out what really makes a competitor tick. You're essentially building a complete picture from lots of different data points.

The idea is to understand their entire business—from product strategy and pricing to their marketing funnel and sales tactics. This intelligence gathering stage is what turns a simple report into a genuine strategic asset.

Analysing Products and Pricing

The most direct comparison you can make is with your competitor's products and pricing. Looking closely at these helps you understand their value proposition and exactly how they position themselves in the market. But don’t just glance at the final price; you need to dissect the whole package.

Start by mapping out their different product or service tiers. What features come with each level? Who are they targeting with each plan? The answers often reveal who they see as their most important customers.

For instance, a rival software firm might have a free basic plan with limited features, a mid tier option for small businesses, and a full blown enterprise solution. This structure tells you they’re aiming for a wide market, from solo users to massive corporations, and it can shine a light on gaps you could potentially fill.

A competitor’s pricing is more than just a number; it’s a statement about their perceived value, their target market, and their confidence in their offering. Scrutinise it accordingly.

This process means looking at:

- Feature Sets: Make a detailed list of features for each of their products and compare them directly against yours.

- Pricing Tiers: Note the cost of each plan (monthly vs. annual) and any discounts they offer for longer commitments.

- Hidden Costs: Are there sneaky setup fees, add-on charges, or expensive support packages?

- Value Proposition: What’s the core benefit they're selling at each price? Is it speed, convenience, quality, or something else?

By doing this, you might find that while your product has more features, a competitor's simpler, cheaper option is winning over a market segment you've completely overlooked.

Decoding Marketing and Sales Funnels

Understanding how competitors attract and convert customers is just as crucial as knowing what they sell. This involves reverse engineering their marketing and sales funnel to map out the customer journey they’ve built.

Start at the top of their funnel by checking out their content marketing. What topics are they covering on their blog? Are they producing videos, podcasts, or white papers? The content they create is a massive clue about the audience they’re trying to reach and the problems they want to solve.

Next, look at how they capture leads. Are there prominent newsletter signup forms? Do they offer free downloads for an email address or run webinars? A great tip is to sign up for their mailing list yourself. It gives you a front row seat to their email marketing, letting you see their messaging, how often they send promotions, and their sales tactics firsthand.

Essential Tools for Gathering Intelligence

Trying to gather all this data manually would be an absolute nightmare. Luckily, there are plenty of powerful tools—both free and paid—that can automate most of the work and give you much deeper insights. A 2025 Crayon report revealed that a staggering 44% of companies admit to having zero competitor visibility. That’s a huge blind spot, but one that’s easily fixed with the right tech.

Here’s a quick breakdown of the tools that get the job done:

| Tool Category | Purpose | Example Tool (Free) | Example Tool (Paid) |

|---|---|---|---|

| SEO Analysis | Uncover competitor keywords, backlinks, and organic traffic sources. | Google Keyword Planner | Ahrefs, SEMrush |

| Social Media Listening | Track brand mentions, sentiment, and engagement across social platforms. | TweetDeck | Sprout Social, Brandwatch |

| Content Performance | Identify top performing content and viral topics in your niche. | Google Trends | BuzzSumo |

| Paid Advertising | Analyse competitor ad copy, landing pages, and estimated ad spend. | Google Ads Library | SpyFu, iSpionage |

| Website Technology | See what powers a competitor's website, from their CMS to analytics tools. | Wappalyzer | BuiltWith |

These tools provide the raw data you need to build a comprehensive profile. For a really deep dive into social media, learning to use Twitter analytics for other accounts gives you an invaluable edge. It's this level of detail that separates a basic overview from a truly strategic analysis.

Ultimately, the intelligence you gather is the bedrock of your entire strategy. It allows you to make informed decisions instead of just guessing what might work. The data you collect is essential for harnessing the power of data-driven marketing strategies for success , turning insights into real business growth. When you connect the dots, you don’t just see what your competitors are doing, but why they’re doing it—giving you the foresight to anticipate their next move and plan your own.

Deconstruct Your Competitors' Digital Strategy

Want to know what your competitors are really doing to win business? Look at their digital strategy. It’s their playbook, laid bare, showing you exactly how they find customers, what they prioritise, and where their blind spots are. A clumsy online presence is a huge vulnerability, and if you know where to look, you can find strategic gaps just waiting to be exploited.

This isn’t about a single metric. It’s about piecing together the puzzle of their entire digital footprint—from their search engine performance right through to how they chat with customers on social media. Each piece gives you a clue, and together, they paint a crystal clear picture of their game plan.

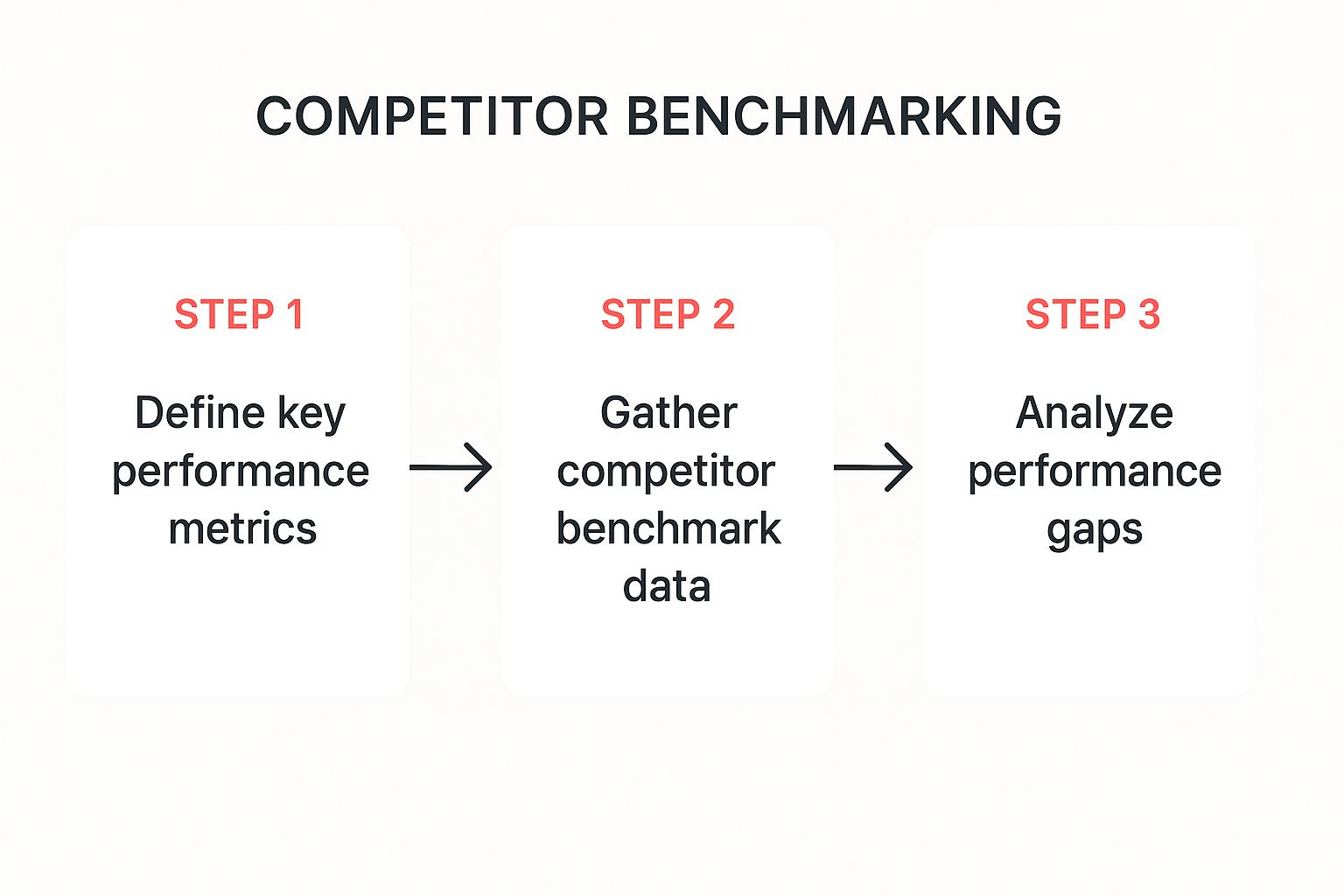

This infographic gives a simple overview of the benchmarking process.

As you can see, it's a flow: you define what matters, gather the right data, and analyse the gaps to turn raw numbers into smart moves for your own business.

Before we dive in, it's worth having the right tools for the job. You don't need a huge budget to get started, but having a few key platforms on hand makes the whole process much faster and more accurate.

Here’s a quick rundown of the essential tools I recommend for getting a clear view of your competitor's digital world.

Essential Tools for Digital Competitor Analysis

| Tool Category | Example Tool (Free) | Example Tool (Paid) | Primary Use Case |

|---|---|---|---|

| SEO & Keyword Research | Google Keyword Planner | Ahrefs / Semrush | Uncovering top keywords, analysing backlink profiles, and auditing site health. |

| Content Analysis | AnswerThePublic | BuzzSumo | Identifying popular content topics and formats that resonate with your audience. |

| Social Media Monitoring | Platform specific analytics | Sprout Social | Tracking engagement, follower growth, and social media advertising strategies. |

| Paid Ad Intelligence | Meta Ad Library | SpyFu | Seeing the ads competitors are running, their messaging, and landing pages. |

These tools give you a starting point. Whether you're using free versions or investing in paid subscriptions, they'll help you pull back the curtain on what's working for others in your space.

Pinpointing Their SEO Strengths and Weaknesses

Search Engine Optimisation (SEO) is the engine room of most strong digital strategies. Digging into a competitor's SEO tells you exactly how they’re pulling in organic traffic—which is often the most valuable source of leads you can get. The mission here is simple: find out which keywords are making them money and figure out how authoritative their website really is.

Start with their top ranking keywords. Tools like Ahrefs or Semrush are perfect for this. They’ll show you exactly which search terms are putting them on the first page of Google. Are they going after big, broad keywords with tons of search volume, or are they cleverly targeting niche, long tail phrases that scream "I'm ready to buy"?

Next, get a look at their backlink profile. Backlinks are basically recommendations from other websites, and a healthy profile is a massive driver for search rankings. It’s not just about quantity; quality is everything. A rival with thousands of links from respected, high authority sites is a serious player. But one with a load of spammy, low quality links has a glaring weakness you can drive a truck through.

Finally, do a quick technical SEO check on their website. How fast does it load? Is it easy to use on a mobile phone? A slow, clunky site is an open goal for a competitor with a faster, smoother experience.

The real gold in SEO analysis isn't just a list of keywords. It's about understanding the customer problems your competitors are solving. Every keyword they rank for is a direct reflection of a question your shared audience is asking.

This kind of analysis has an extra layer in the UK. The regulatory landscape here, particularly since the new Digital Markets, Competition and Consumers Act (DMCCA) came into force, has changed the game. The Competition and Markets Authority (CMA) now has serious powers to investigate market behaviour. This means UK businesses need to watch not just what competitors are selling, but how they’re complying with the rules.

Analysing Their Content Marketing Engine

A competitor's content is a direct line into their brand’s personality, their expertise, and how they talk to their audience. Great content builds trust and positions a brand as an authority, gently guiding people from casual interest to a sale. By breaking down their content, you can see what’s working with your target market and, more importantly, what they’re completely ignoring.

First, take an inventory of the kinds of content they're putting out there.

- Blog Posts: Are they writing deep, comprehensive guides, or are they just churning out short, fluffy news updates? The depth and quality tell you a lot.

- Videos: Look for tutorials, product demos, or brand stories. Video engagement is a huge signal of how connected an audience feels.

- Case Studies & White Papers: This kind of high value content usually means they're targeting a more serious B2B audience.

- Podcasts: If they have a podcast, they're investing in building a loyal, long term audience. What topics are they owning in the audio space?

Once you know what they’re making, look at how it's performing. Which articles, videos, or guides are getting the most social shares, comments, and backlinks? This is your cheat sheet for the topics and formats that your audience loves.

Decoding Their Social Media and Paid Advertising

Social media is the modern day town square where brands build communities and have real conversations. Sizing up a competitor's social channels tells you everything about their brand's personality and how they foster engagement. See which platforms they focus on. Are they all in on the visual appeal of Instagram, the professional networking of LinkedIn, or the rapid fire conversations on X (formerly Twitter)?

Look past the vanity metrics. A brand with 100,000 followers but only five likes per post has a dead audience. Compare that to a competitor with 10,000 followers who are constantly commenting, sharing, and talking back. That's the audience you want.

Finally, peek at their paid advertising. This is where they’re putting their money where their mouth is, targeting specific groups with laser focused messages. You can use free tools like the Meta Ad Library to see the exact ads they’re running. Study their ad copy, their images, and the landing pages they're sending people to. This is an incredible source of insight into their sales funnels and promotional offers.

This kind of digital deep dive is a fundamental part of a wider marketing strategy. As our guide on search engine marketing explained covers, it's about seeing how all the pieces—organic and paid—fit together. By taking apart their entire digital machine, you can find out precisely where to focus your efforts to outsmart them.

Analyse the Unique UK Market Landscape

Competitor analysis is never done in a vacuum. Context is everything. You need to understand the wider market, especially the unique dynamics here in the UK, if you want to turn raw data into a real world strategy.

It’s one thing to know what your direct rival sells. It’s another thing entirely to grasp the economic and structural forces that shape their decisions and give them power.

That means zooming out to see the entire competitive food chain. This is especially vital for smaller businesses. You’re not just competing with other local firms; you’re often operating in the shadow of industry giants whose sheer scale gives them massive structural advantages.

Benchmarking Against Industry Giants

Certain sectors in the UK are completely dominated by colossal companies with almost bottomless resources. These players benefit from economies of scale, sprawling supply chains, and enormous R&D budgets that smaller firms simply can’t hope to match. Trying to compete with them head on is usually a fast track to failure.

Instead, the real goal is to understand their position so you can find your own unique space.

By benchmarking against these giants, you can start to spot the gaps they leave behind. They might be too large to serve a niche audience properly, or too slow to react to new trends. That’s where opportunities for more agile businesses are born.

A perfect example is the mind boggling scale of the UK’s largest corporations. As of early 2025, AstraZeneca leads the pack with a valuation of £186.59 billion —over 10% higher than the next biggest, Linde, which is valued at £169.1 billion . Only three other companies even break the £100 billion mark: HSBC (£155.42 billion), Shell (£155.04 billion), and Unilever (£115.07 billion).

If you operate in or around pharmaceuticals, banking, energy, or consumer goods, you have to appreciate this scale. You can find more insights on UK business statistics and valuations to get the full picture.

These aren’t just abstract numbers; they represent raw market power and an influence that shapes the entire landscape.

Reading Between the Lines of Market Data

Looking at market cap is just the start. Revenue figures often tell an even more powerful story about a company’s operational might and market reach. These numbers show the true difference in scale and really hammer home why a direct fight is often a bad idea.

Take the energy sector again. Shell’s annual revenue was a staggering £284.31 billion . That’s nearly two thirds ( 64% ) more than BP, its closest UK competitor, at £189.18 billion. That huge gap in revenue translates directly into more purchasing power, bigger marketing budgets, and a much deeper ability to absorb market shocks.

When you’re looking at these giants, hunt for clues about their strategic priorities:

- Investment Reports: Annual reports are a goldmine. They often detail where a company is putting its R&D budget, which signals its future product direction.

- Acquisitions: Keep an eye on the smaller companies they are buying up. This is a classic tell for how they plan to enter new markets or acquire new tech.

- Public Statements: CEO interviews and press releases can give you incredible insight into their long term vision and what they see as major threats.

This kind of analysis helps you anticipate broad market shifts being driven by the biggest players on the board.

Understanding the competitive hierarchy isn't about being intimidated by the giants. It's about using their scale and slow pace to your advantage, finding the nimble, strategic moves they are simply too big to make.

Finding Your Niche in a Crowded Market

For a smaller business, all this analysis comes down to one thing: identifying a sustainable niche. The data on market leaders helps you answer the most critical questions about your own strategy. Where can you offer value that they can’t?

This might mean:

- Superior Customer Service: Huge corporations often struggle with personalised service. This creates a golden opportunity for smaller firms to build fiercely loyal customer relationships.

- Specialised Expertise: Focus on a very specific slice of the market that is too small for a giant to bother with profitably.

- Local Knowledge: Use your deep understanding of the local community and its unique needs in a way a multinational never could.

- Agility and Speed: Respond to market changes and customer feedback far more quickly than a large, bureaucratic organisation ever can.

By truly understanding the structural advantages of the market leaders, you can start to define your own. Your competitor analysis stops being about mimicking rivals and starts being about carving out your own distinct, defensible position in the UK market.

Turn Your Analysis into an Actionable Strategy

Right, you’ve done the hard graft. You’ve gathered the data, crunched the numbers, and stared at spreadsheets until your eyes hurt. But let's be honest, all that information is worthless if it just sits there.

This is where the real work begins. The final, and most critical, part of any competitor analysis is turning those hard won insights into a winning game plan. This is the moment your research stops being a document and starts becoming a genuine competitive advantage.

It's time to shift from observation to action. You’ve seen what your rivals are doing—now, what are you going to do about it? You need a solid framework to help organise your thoughts and decide what moves to make next.

Using SWOT to Make Sense of It All

One of the most reliable ways to process all this competitive data is the classic SWOT analysis. It’s been around for ages for a reason: it works. It forces you to map what you’ve found against your own business, looking at the entire landscape from four distinct angles.

In case you need a refresher, SWOT stands for Strengths , Weaknesses , Opportunities , and Threats . It’s a beautifully simple, yet incredibly powerful, tool for strategic planning.

- Strengths (Internal): What gives you an edge over the competition? This could be a better product, a stronger brand reputation, or slicker operations. Your analysis should now back these up with cold, hard market data.

- Weaknesses (Internal): Where are the cracks? Are competitors consistently outranking you for crucial keywords? Is their pricing making your offer look a bit steep? Be brutally honest with yourself here.

- Opportunities (External): Where are the gaps your research has uncovered? Maybe a major rival has a string of terrible customer reviews, opening a door for you to win on service. Perhaps they're completely ignoring a social media platform where your audience hangs out.

- Threats (External): What’s on the horizon that could cause problems? This might be a new player entering the market, a rival launching a cut throat pricing strategy, or a fundamental shift in what your customers want.

This framework takes the chaotic mess of data and organises it into a clear map, showing you exactly where to focus your energy for the biggest impact.

The real point of a SWOT analysis isn't just to make four lists. It’s about connecting the dots—using your strengths to jump on opportunities, shoring up weaknesses to fend off threats, and building a strategy that’s both proactive and defensive.

From Insights to Smart Decisions

With your SWOT complete, you suddenly have a much clearer picture of where you stand. Now you can begin making specific, data backed decisions to sharpen your strategy and really drive growth.

Let me be clear: this isn’t about blindly copying your competitors. It's about learning from their playbook to write a better one of your own.

For instance, if your analysis reveals a competitor is smashing it with video content, the kneejerk reaction might be "we need to make more videos!" But a smarter move might be to spot the opportunity they've missed. Perhaps that means launching a podcast for an audience that prefers listening on the go, or creating in depth written guides they’ve neglected.

Practical Steps You Can Take Now

So, how do you actually turn all this into action? Here are a few concrete steps you can start with:

- Refine Your Value Proposition: Use what you’ve learned about competitor messaging to sharpen what makes you unique. If everyone else is locked in a race to the bottom on price, maybe you can stand out by doubling down on quality or unbelievable customer support.

- Rethink Your Pricing Model: Your analysis might have flagged that your pricing feels out of step with the market. This could mean tweaking your tiers, introducing a new entry level plan, or adding more value to justify a premium price point.

- Innovate Your Product or Service: Look for features your rivals are missing or common customer complaints they aren't fixing. These are goldmines—massive opportunities for innovation that can give you a serious edge.

- Sharpen Your Marketing Message: Find the gaps in how your competitors communicate. If they all use stuffy corporate jargon, you can win hearts and minds by speaking to customers in a simple, direct, and human way.

Ultimately, the entire point of this process is to turn raw information into usable intelligence. By systematically analysing your competitors and mapping those findings against your own business, you build a strategy that's resilient, informed, and ready to win.

Your Burning Questions Answered

When you first dive into competitor analysis, a few common questions always seem to surface. Let's tackle them head on with some straight talking, practical answers to get you on the right track.

How Often Should I Run a Competitor Analysis?

Honestly, there’s no magic number. It all comes down to the pace of your industry. If you’re in a fast moving space like tech or e-commerce, a deep dive every quarter is a smart move. It keeps you sharp and ahead of the curve.

For more traditional, stable industries, a major analysis once or twice a year will probably do the trick. The real key, though, is continuous monitoring . You should never be in the dark about a rival’s new product launch, a surprise price slash, or a big marketing push. Set up alerts for their news and socials to stay plugged in between the more intensive reviews.

What Are the Biggest Mistakes People Make?

The number one pitfall? Collecting mountains of data with no clear goal. This leads straight to ‘analysis paralysis’ – you’re drowning in information but have zero actionable insights.

Another classic error is developing tunnel vision. By focusing only on your direct, obvious competitors, you leave yourself wide open to being blindsided by an up and comer who completely changes the game. And please, don’t rely on a single source of data. That’s a recipe for a skewed picture. Always cross reference your findings.

But the most critical mistake is treating this as a one and done task. Competitor analysis isn't a report you create, file away, and forget. It should be a living, breathing part of your business strategy, constantly shaping your decisions.

Is It Actually Ethical to Analyse My Competitors?

Yes, 100% . Competitor analysis is a standard, ethical, and essential business practice. The crucial distinction lies in how you gather your information. It’s all about sticking to publicly available data.

Ethical intelligence gathering is all about using information that’s out in the open, such as:

- Their official website and blog posts

- Public social media activity

- Press releases and news coverage

- Company reports filed publicly

- Third party analysis tools and customer reviews

What crosses the line is anything like corporate espionage, trying to steal private information, or lying to get insider details. The aim is to learn from public data to sharpen your own strategy, not to do anything shady.

Ready to turn competitive insights into a powerful growth strategy? The expert team at Superhub can help you analyse your market and build a bespoke plan to outperform your rivals. Learn more about our digital marketing services.

Want This Done For You?

SuperHub helps UK brands with video, content, SEO and social media that actually drives revenue. No vanity metrics. No bullshit.