How to Measure Brand Awareness: A UK Guide for Growth

Measuring brand awareness isn't about chasing vanity metrics. It's about getting a real-world grip on your market position so you can make smarter, more confident decisions with your budget.

This means looking beyond the obvious. You need to blend the hard numbers, like direct website traffic and social media reach , with the more human insights you get from customer surveys and social listening . This combined approach tells you not just if people know you exist, but how they actually feel about you.

Why Tracking Brand Awareness Is Non-Negotiable

Let’s be direct. Too many UK businesses still dismiss brand awareness as a vague, 'fluffy' concept. They see it as a nice-to-have, something that comes a distant second to hard sales figures. This is a costly mistake.

In fiercely competitive sectors like motorsport, automotive, or tourism—where trust and reputation are everything—brand awareness is a direct indicator of your future revenue. It's not fluff; it's a fundamental asset.

The Real Cost of Flying Blind

Ignoring brand awareness means you're making critical marketing decisions completely in the dark. Without the data, you have no real way of knowing if your budget is actually working.

Are people remembering your brand after seeing your sponsorship at a race track? Does that latest social media campaign truly resonate with potential customers, or is it just adding to the noise?

When you don't track awareness, you're left guessing. This leads to wasted spend, missed opportunities, and a constant, frustrating struggle to connect with the right audience. A strong brand doesn't just look good; it actively works for you, day in, day out.

A powerful brand presence shortens your sales cycle. When customers already know and trust you, the path from initial contact to conversion is significantly faster. It’s the difference between a cold call and a warm introduction.

More Than Just a Number

Effective brand measurement gives you tangible benefits that go far beyond a simple percentage increase on a report. For our clients here in Devon and across the UK, we've seen first-hand how a deliberate focus on brand impacts the entire business.

- Attracting Top Talent: The best people want to work for brands they recognise and respect. Strong awareness makes recruitment easier and more cost-effective.

- Commanding Higher Prices: Brands with strong recall can justify premium pricing because they've built perceived value and trust in the market. Simple as that.

- Building a Defensive Moat: When a new competitor enters your space, a well-established brand provides a powerful defence. Familiarity breeds loyalty.

- Improving Marketing Efficiency: By understanding which channels are most effective at building awareness, you can allocate your budget more intelligently, improving your overall return on investment.

This shift towards data-backed brand building is being recognised across the UK. In fact, 62% of Chief Marketing Officers now track brand awareness as their most important metric after a campaign—a 20% increase from the previous year .

It highlights just how vital it has become to prove campaign success with solid brand data. To learn more, you can explore the CMO focus on brand metrics and its implications for UK businesses.

This guide will give you the practical, no-nonsense tools to start measuring what truly matters.

Measuring Reach with Quantitative Data

Right, let's get into the hard numbers. While 'brand' can feel a bit abstract, its digital footprint is anything but. Quantitative data gives you the concrete evidence you need to show your brand is gaining traction and to justify your marketing spend.

We're going to skip the vanity metrics like follower counts. Instead, we’ll focus on data that signals genuine growth in awareness. This means digging into website traffic, analysing brand search volume, and figuring out your real reach on social media.

Digging into Direct Website Traffic

Direct traffic is a powerful, if often overlooked, indicator of brand awareness. These are the visitors who type your website address straight into their browser or click a bookmark. They didn't stumble across you via Google or a social media link; they came to you on purpose.

A steady increase in direct traffic over time is a clear signal that your brand recall is growing. It tells you that people know who you are and where to find you without needing a prompt.

You can isolate this in Google Analytics 4 (GA4) by heading to the 'Traffic acquisition' report. From there, filter the 'Session default channel group' to view 'Direct' traffic. Look for consistent upward trends, especially after a big marketing push, like sponsoring a local event in Devon or a national PR campaign.

Analysing Brand Search Volume

What’s even better than someone knowing your URL? Someone actively searching for your brand by name. This is called branded search volume , and it's a gold-standard metric for awareness. It shows people associate your brand name with a solution to their problem.

The simplest, most effective tool for this is Google Trends. It lets you track interest in your brand name over time, compare it against competitors, and even see which regions in the UK are showing the most interest. This is incredibly useful for spotting emerging markets or validating the impact of regional campaigns.

For instance, here's a Google Trends chart comparing search interest for two fictional automotive brands in the UK over the last 12 months.

The data clearly shows that "Brand A" (the blue line) has consistently higher search interest and saw a major spike in November, which likely corresponds with a big campaign or event.

This kind of analysis provides an undeniable, at-a-glance view of your brand's visibility. You can also use Google Search Console to see the exact queries driving traffic, confirming how many visitors arrive via branded terms versus generic ones. This data is critical when you need to measure marketing campaign success with tangible proof.

The table below breaks down the key quantitative metrics, what they measure, and the primary tools you'll need to track them.

Essential Quantitative Brand Awareness Metrics

| Metric | What It Measures | Primary Tool(s) |

|---|---|---|

| Direct Traffic | The number of visitors who arrive by typing your URL directly. Indicates strong brand recall. | Google Analytics 4 (GA4) |

| Branded Search Volume | The frequency people search for your brand name or specific products by name. | Google Trends, Google Search Console |

| Social Reach & Impressions | How many unique users see your content (Reach) and the total views it gets (Impressions). | Native Social Media Analytics |

| Share of Voice (SOV) | Your brand’s percentage of the total online conversation compared to competitors. | Brandwatch, Talkwalker, Meltwater |

These metrics form the bedrock of your brand awareness measurement, giving you a clear, data-backed picture of your market presence.

Assessing Social Media Reach and Share of Voice

While follower counts are misleading, social media does provide other vital quantitative metrics. The key is to look beyond your own page.

- Reach & Impressions: These metrics tell you how many unique users saw your content ( reach ) and the total number of times it was displayed ( impressions ). A growing reach shows your content is successfully breaking out of your immediate follower base.

- Share of Voice (SOV): This measures how much of the conversation in your industry revolves around your brand compared to competitors. You calculate SOV by tracking mentions of your brand across social media and the web, then comparing that volume to your key rivals.

Tracking Share of Voice moves you from simply broadcasting content to understanding your actual influence. It answers a crucial question: "Are we just talking, or are people actually listening—and talking about us more than the competition?"

To track these properly, you need more than the native analytics on Facebook or LinkedIn. Social listening tools are essential for capturing mentions beyond your own channels and calculating an accurate Share of Voice. This data helps you understand your market position and pinpoint where competitors are winning the conversation.

Getting Under the Skin of Your Brand: What Do People Really Think?

Numbers tell you what’s happening. They don’t tell you why. While all those quantitative metrics track your visibility, qualitative insights are where you uncover how people actually feel about your brand. This is the crucial shift from simply counting mentions to truly understanding perception.

For businesses built on passion—like motorsport or tourism—sentiment is everything. A loyal fanbase is built on emotion, not just impressions. This is where you get to the heart of what your audience thinks and says about you when you're not in the room.

Running Brand Perception Surveys That People Actually Finish

Surveys are a direct line to your audience, but a badly designed one is a fast track to the bin. You have to respect people's time and ask questions that deliver real, actionable answers.

Your main goal here is to measure two types of recall:

- Unaided Recall: This is the gold standard. It tells you who thinks of you without any prompting. The classic question is, "When you think of [your industry, e.g., 'performance car tuning in the UK'], which companies come to mind first?"

- Aided Recall: This is about recognition. After the unaided question, you follow up with something like, "Which of the following brands have you heard of?" and pop your brand in a list with key competitors.

To get honest feedback, keep your surveys short, sharp, and mobile-friendly. A five-minute survey will always beat a twenty-minute interrogation.

Asking Questions That Deliver Proper Insight

The quality of your feedback lives or dies by the quality of your questions. Steer clear of leading questions and use open-ended prompts to encourage genuine, off-the-cuff responses.

Imagine you’re a Devon-based tourism business.

-

Vague Question: "Do you like our brand?"

-

Better Question: "What three words come to mind when you think of [Brand Name]?"

-

Leading Question: "Don't you agree our customer service is excellent?"

-

Better Question: "Describe your most recent experience with our customer service team."

This approach gives you the exact language your customers use to describe you—gold dust for refining your marketing messages. These insights are also foundational for building real brand authority, which goes far beyond simple name recognition. For more on this, check out our guide on the role of content marketing in building brand authority.

Using Social Listening to Tune into the Conversation

What people say about you is often more honest than what they say to you. Social listening is about using tools to monitor mentions of your brand, your competitors, and key industry topics across social media, forums, and blogs.

This isn't just about damage control. It’s a strategic intelligence-gathering mission. By tuning into the public conversation, you can:

- Gauge Sentiment: Are mentions of your brand generally positive, negative, or neutral? Tools like Brandwatch or Sprout Social can automate this for you.

- Identify Pain Points: What are customers in your sector complaining about? This is a direct line into market needs and opportunities.

- Track Competitor Moves: See how people are reacting to your competitors' campaigns or service issues in real-time.

Social listening lets you be a fly on the wall in your own market. It provides unfiltered feedback and flags emerging trends or potential PR crises before they blow up, giving you a massive strategic advantage.

The power of perception is clear in wider market trends. For instance, awareness of B Corp Certification in the UK has jumped from 34% in 2022 to 51% in 2024 . This shows just how quickly perception can shift when a brand aligns with consumer values. As UK shoppers increasingly look for trust signals like certifications, measuring awareness becomes about what your brand stands for , not just whether they’ve heard of you. You can read more about the rise of B Corp awareness to see how these trends evolve.

By blending direct feedback from surveys with the unfiltered intel from social listening, you build a complete, nuanced picture of how your brand is really seen.

Building Your Brand Measurement Framework

Collecting data is one thing; making sense of it is another. Great data is useless without a plan. You need a simple, repeatable framework to turn those numbers and feelings into a coherent story about your brand's health. This is about building a sustainable process, not just pulling a one-off report.

This framework isn't about creating more work. It’s about creating clarity. It makes sure you’re tracking the right things, so you can make quick, confident decisions. Without one, you’re just swimming in data with no direction.

Set Clear and Realistic Goals

Before you track a single metric, you have to know what you’re trying to achieve. "Increase brand awareness" is not a goal; it's a wish. A proper goal is specific, measurable, and tied to an actual business outcome.

Get specific about what success looks like for you. Your goals should be tailored to where your business is right now.

- For a Startup: "Increase unaided brand recall within the UK motorsport engineering sector from 2% to 5% over the next six months."

- For an Established Business: "Achieve a 15% increase in branded search volume in the South West tourism market during the Q3 holiday season."

- For a B2B Service Provider: "Grow our Share of Voice on LinkedIn for 'automotive marketing solutions' by 10% this quarter."

These goals are concrete. They give you a finish line to aim for and make it easy to see if your efforts are actually working.

Establish Your Baseline Metrics

You can't measure progress if you don't know where you started. Before launching any new campaign, you need to take a snapshot of your current brand awareness. This is your baseline .

Your baseline should include a mix of the quantitative and qualitative metrics we've already covered. Pull your numbers for direct traffic, branded search volume, social reach, and Share of Voice. At the same time, run that initial brand perception survey to gauge current sentiment and recall.

Your baseline is your single source of truth. Every future report, every campaign analysis, will be measured against this starting point. Don't skip this step; it's the foundation of your entire framework.

Create a Simple Reporting Schedule

Consistency is key. You don't need to check every metric every single day, but you do need a regular rhythm for reviewing your data. Overcomplicating this is a fast track to abandoning it altogether.

Here’s a practical schedule we use with our clients:

- Weekly Check-in (15 minutes): A quick glance at high-level social media metrics. Are there any unusual spikes in mentions or engagement? Any potential PR issues brewing? This is about spotting immediate fires.

- Monthly Review (1 hour): This is your main pulse check. Dive into your Google Analytics for direct traffic and branded search trends. Review your social listening reports for sentiment changes and Share of Voice. This is where you spot emerging trends.

- Quarterly Deep Dive (Half-day): This is for strategic analysis. Rerun your brand perception survey to see how sentiment and recall have shifted. Compare your monthly metrics against your baseline and your goals. This is when you ask the big questions: "What worked? What didn't? Where should we focus our budget next quarter?"

To really nail your brand measurement framework, exploring various brand tracking software solutions can streamline the whole process, especially for those bigger monthly and quarterly reviews.

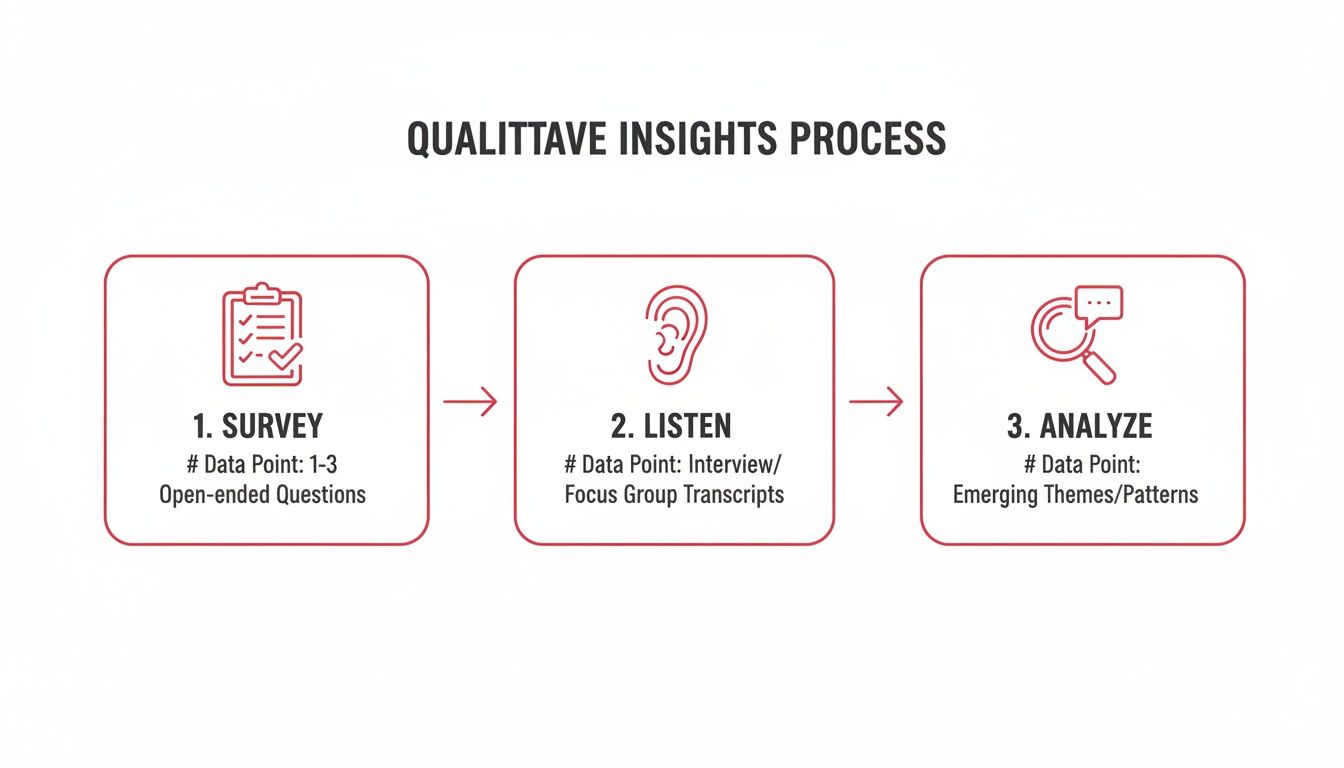

The process of gathering qualitative insights—surveying, listening, and analysing—forms a continuous loop that feeds directly into this reporting schedule.

This simple, three-step cycle ensures you’re constantly gathering fresh perception data to compare against your hard numbers.

Turning Brand Data Into Strategic Action

Collecting data is the easy part. The real challenge is turning those charts, percentages, and survey responses into smart, profitable action. A dashboard full of metrics is just noise if it doesn't lead to better marketing decisions. This is where you connect the dots between what the data says and what your business does next.

Interpreting your brand data is about finding the stories hidden within the numbers. It’s about spotting trends, understanding context, and having the confidence to act on what you discover. This isn't guesswork; it’s a strategic process for translating insights into tangible improvements for your SEO, content, and PPC efforts.

Interpreting the Signals

Your brand data rarely gives you a single, simple answer. Often, you'll see conflicting signals that need a bit of detective work. The key is to look at how different metrics play off each other to build a complete picture.

What does a spike in social media mentions mean if the sentiment is overwhelmingly negative? It’s a fire alarm. Your immediate action isn’t to celebrate the increased 'buzz' but to dive into the comments, find the root cause of the problem, and roll out a swift customer service or PR response.

And what if direct traffic is flat, but your branded search volume is steadily climbing? This is a great sign that your brand is becoming memorable, but perhaps your calls-to-action are weak or your website isn't the first place people think of going. This insight should trigger a review of your off-site content and marketing messages to make sure you're funnelling that interest directly to your digital front door.

The goal is to move from "what happened?" to "why did it happen and what should we do now?". Data shows you the 'what'. Your analysis uncovers the 'why'. Your strategy dictates the 'what's next'.

Benchmarking Against the Competition

Your brand doesn't exist in a vacuum. A 10% increase in your Share of Voice sounds great until you realise a key competitor achieved 30% in the same period. Context is everything. Keeping a close eye on your rivals is essential for understanding your true position in the market.

Regularly track their branded search volume using tools like Google Trends and monitor their social media sentiment. This comparative analysis helps you spot their weaknesses and identify opportunities. If their customers are complaining about poor service, your next campaign could be built around your brand's commitment to excellent support.

This kind of intelligence lets you make proactive, not reactive, decisions. It helps you anticipate market shifts and adjust your strategy before you get left behind.

Turning Insights Into Marketing Action

Every piece of data should point towards a potential action. The table below offers a practical framework for translating common brand awareness signals into concrete marketing tasks. This is how you close the loop between measurement and actually doing something with it.

This table is a practical guide to understanding what different data combinations mean and the strategic actions you should consider.

How to Interpret Brand Awareness Signals

| Data Signal | Potential Meaning | Recommended Action |

|---|---|---|

| High Reach, Low Engagement | Your content is being seen but isn't resonating. The message might be generic or irrelevant. | A/B test different creative, headlines, and calls-to-action. Refine your audience targeting. |

| Rising Branded Search, Stagnant Direct Traffic | People remember your name but not your URL. Your brand is memorable, but your website isn't the primary destination. | Strengthen on-page CTAs across all content and ensure your website is clearly signposted in all campaigns. |

| Positive Sentiment but Low Share of Voice | Your existing audience loves you, but you're struggling to reach new people. | Identify and collaborate with industry influencers. Invest in targeted PR to expand your reach into new publications. |

| Spike in Mentions with Negative Sentiment | A product issue, poor customer experience, or PR misstep has occurred. | Immediately activate your social listening tools to diagnose the core problem and implement a crisis response plan. |

Ultimately, the entire point of measuring brand awareness is to fuel a cycle of continuous improvement. The data you gather should directly inform your strategy, helping you make smarter budget allocations and create more impactful campaigns.

It's not just about tracking numbers; it's about using those numbers to build a stronger, more resilient brand. This proactive approach is central to any successful strategy, as our guide on how to increase brand awareness that lasts explains in more detail.

To truly understand your impact, it's essential to move past simple counts and learn how to measure social media success beyond vanity metrics , focusing on actionable insights. This process ensures every marketing pound is working as hard as possible to grow your business.

A Few Common Questions About Brand Awareness

Alright, we’ve walked through the framework for measuring brand awareness. But I know from experience that this is where the practical questions start to surface. When you're trying to apply this stuff to your own business, a few common hurdles always pop up.

Here are the straight answers to the questions we get asked most often.

How Often Should I Actually Be Measuring This Stuff?

This is a big one. It's easy to fall into the trap of obsessively checking your metrics every day, but that’s a fast track to madness and misinterpretation. Brand perception doesn't change overnight.

Think about it in layers. Your high-level, quantitative data—things like direct traffic from Google Analytics 4 (GA4) or social media mentions—are worth a look on a monthly basis . This gives you a decent pulse check and helps you spot any significant trends without getting lost in daily noise.

For the deeper, more qualitative work, like brand perception surveys, you need to give your marketing time to actually work. Running these quarterly or even bi-annually is far more useful. It gives your efforts a chance to move the needle, so the feedback you get reflects a genuine shift in how people see you, not just a blip on the radar.

I’m a Startup. What’s the Most Cost-Effective Way to Start?

If you’re a startup or a small business in Devon, you’re watching every penny. I get it. The good news is you don’t need to drop a fortune on enterprise-level software to get started. You can get surprisingly far with the tools you already have access to for free.

- Google Analytics 4 (GA4): Dive into your direct traffic and branded search queries. It costs nothing and gives you a rock-solid quantitative starting point.

- Google Trends: This is your secret weapon for benchmarking your brand’s search interest against your competitors. Again, completely free.

- Simple Surveys: Use a tool like Google Forms or a basic plan on SurveyMonkey to run a straightforward, unprompted recall survey. Send it to your email list or share it with your social followers.

The key is to begin small and stay consistent. The insights you can gather from these free tools are more than enough to start making smarter, data-backed decisions.

Isn’t Brand Awareness Just Another Term for Lead Generation?

No, and this is probably the most important distinction to make. Confusing the two is a common mistake, and it leads to mismatched expectations and a whole lot of frustration.

Brand awareness is the long game. It’s about building familiarity and trust, making sure that when your ideal customer has a problem you can solve, your name is the first one that comes to mind. Think of it as a marathon.

Lead generation , on the other hand, is a sprint. It’s about triggering a specific, immediate action—someone filling out a form, downloading a guide, or requesting a quote.

Strong brand awareness makes lead generation infinitely easier and cheaper, but they aren't the same thing and you can't measure them in the same way. Your brand campaigns build the foundation; your lead gen campaigns build the house on top of it.

Measuring brand awareness isn't some dark art reserved for marketing agencies; it's a core business discipline. By blending the right data with a consistent framework, you can stop guessing and start building a brand that genuinely commands attention in its market.

If you're ready to get a proper grip on your brand's performance and turn those insights into real growth, SuperHub can build the strategy that delivers.

Find out how we can help at https://www.superhub.biz.

Want This Done For You?

SuperHub helps UK brands with video, content, SEO and social media that actually drives revenue. No vanity metrics. No bullshit.