How to Measure Brand Awareness: A Practical UK Guide

If you want to measure brand awareness properly, you need to get specific. Forget vague goals and start thinking about tangible, concrete objectives that actually link back to business outcomes. It is all about defining what success genuinely looks like for your brand and then picking the right metrics to track your progress.

Why Effective Brand Measurement Matters

Before you even think about surveys, search volume or social media mentions, you need a clear strategy. Just aiming to 'increase awareness' is not a strategy; it is a wish. Without a solid framework, you are just tracking vanity metrics that feel good but do not move the needle on business growth.

The real heart of effective measurement is defining what success means for your specific situation. Are you a startup trying to get noticed in a noisy market? Or are you an established business launching a new product? Each scenario calls for a completely different game plan.

Defining Your Objectives

Your objectives need to be SMART – specific, measurable, achievable, relevant and time-bound. This is how you turn a fuzzy concept like 'awareness' into a plan you can actually execute.

Think about a UK-based company selling motorsport components. A vague goal is "become more well-known". A strategic, SMART objective sounds more like this: "increase unaided brand recall amongst UK motorsport enthusiasts aged 25-45 by 20% within six months". See the difference? Now you have a clear target to aim for.

Getting this level of clarity helps in a few crucial ways:

- It focuses your effort. You know exactly what you are trying to achieve, so you can direct your marketing activities accordingly.

- It tells you what to track. Suddenly, you know which key performance indicators (KPIs) really matter.

- It proves your worth. You can show stakeholders the tangible return on their marketing investment.

Aligning Measurement with Business Goals

Every single metric you track should ultimately tie back to a bigger business goal, whether that is grabbing more market share, driving sales or building a loyal customer base. Brand awareness is not just about being known; it is about being known by the right people for the right reasons.

That connection is what turns measurement from a boring reporting task into a powerful strategic tool.

For instance, if your main goal is to break into a new regional market, your awareness objective might be to hit a certain level of aided awareness in that specific area. The metrics you would focus on—like local search volume and regional social media engagement—would be chosen specifically to reflect that goal.

A well-defined measurement strategy is your brand's compass. It does not just show you where you are; it guides you to where you want to go, making sure every marketing pound is spent with purpose.

Nailing this strategic foundation is the first real step. To get a fuller picture of your brand's impact, it helps to understand related principles, and learning how to measure customer experience can offer some valuable lessons on picking metrics that matter. It helps you build a more holistic view where brand perception and customer interaction are seen as two sides of the same coin.

This alignment ensures you are not just collecting numbers. You are gathering real intelligence that leads to smarter decisions and drives sustainable growth.

Tracking Quantitative Brand Awareness Metrics

While the fuzzy, emotional side of brand perception is crucial, you cannot build a strategy on feelings alone. The real starting point for measuring brand awareness is with cold, hard numbers. These quantitative metrics are the concrete data points that show you exactly how visible your brand is in the market, giving you a clear baseline to work from.

Think of them as your brand's vital signs. They will not tell you the whole story by themselves, but they are absolutely essential for spotting what is working and what is not. Let us dig into the numbers you should have on your radar.

Website Traffic Analysis

For most businesses, your website is ground zero for your brand. This makes its traffic data a goldmine for understanding awareness. The key is not just how many people visit, but how they get there.

One of the most telling metrics is direct traffic . These are the people who type your website address straight into their browser or click on a bookmark. It is a powerful signal that they already know who you are and are deliberately coming to you—the very definition of brand awareness.

You can find this data easily in Google Analytics under the 'Acquisition' reports. If you see your direct traffic climbing steadily over time, it is a good sign your brand-building efforts are paying off.

Imagine a new coffee roaster in Manchester runs a few local radio ads and sponsors a community event. By keeping an eye on their direct traffic, they could see a tangible spike in visitors, directly connecting those offline activities to an increase in local brand recall.

Your direct traffic is a great proxy for brand recall. When people remember your name and actively seek you out, you know you have made a genuine impression.

Do not stop at direct visits, though. You also need to look at branded search traffic . This covers anyone who finds you by typing your company name or specific product names into a search engine. Tools like Google Search Console will show you the exact branded terms people are using, offering clear insight into how your audience thinks about your business. To get the full picture, it is worth understanding how to measure marketing campaign effectiveness in the UK.

Branded Search Volume

While website traffic tells you who made it to your door, branded search volume tells you how many people are looking for the door in the first place. This metric simply measures how many times your brand name is searched for over a given period. It is a fantastic gauge of public interest and curiosity.

If this number is on the up, it suggests your marketing is grabbing attention and prompting people to find out more.

Here are a couple of ways to track it:

- Google Trends: A free and simple way to see the relative search popularity of your brand name over time. You can even pit your brand against competitors to see how you stack up.

- SEO Tools: Platforms like Semrush or Ahrefs give you more granular data, including estimated monthly search volumes for your brand and related keywords.

This is a metric you cannot afford to ignore. If you see a big jump in search volume right after launching a new PR campaign, you have a strong indicator that the message is landing and driving genuine interest.

Social Media Metrics

Social media is overflowing with data that ties directly to brand awareness. While likes and comments are great for measuring engagement, a couple of other numbers give you a much clearer view of your brand’s visibility.

The two main metrics to watch here are:

- Reach: The total number of unique people who saw your content. This tells you the sheer size of the audience your message has touched.

- Impressions: The total number of times your content was displayed on a screen, whether it was clicked or not. High impressions mean the algorithm is actively pushing your content to users.

Of course, tracking your follower growth is also a straightforward way to see if your brand is pulling in a bigger crowd. A steady increase means people find you interesting enough to want you on their feed, which is a solid win.

By consistently keeping tabs on these quantitative metrics—direct traffic, branded search and social reach—you start to build a data-driven picture of your brand's footprint in the market. This numerical foundation is the first, essential step to truly understanding your presence.

Uncovering Qualitative Insights: The ‘Why’ Behind the Numbers

Quantitative data is brilliant at giving you a snapshot of what is happening. It tells you how many people are searching for your brand or visiting your site. But it almost never tells you why.

To get the full picture, you need to dig deeper into the thoughts and feelings of your audience. This is where qualitative measurement comes in. It is the stuff that adds colour and context to your spreadsheets, helping you understand the perceptions, opinions and emotions tied to your brand.

Combine these insights with your hard data, and you have got a much smarter, more actionable strategy.

Conducting Brand Perception Surveys

The most direct way to find out what people think of you? Just ask them. A well-designed brand perception survey does more than just check for name recognition; it helps you gauge sentiment and see if your key messages are actually hitting home.

To get this right, you need to ask the right questions. The goal is to test two crucial types of awareness:

-

Unaided Recall: This is the gold standard. It measures how many people can name your brand without any clues. Think questions like, "When you think of digital marketing agencies in Devon, which names come to mind?"

-

Aided Recall: This checks for recognition when your brand is presented as one of several options. For instance, "Which of the following agencies have you heard of?" followed by a list including your name and your main competitors.

The difference is huge. Strong unaided recall means you are top of mind. High aided recall suggests a level of familiarity you can definitely work with.

The real gold in these surveys is not the 'yes' or 'no'. It is in the open-ended questions. Asking "What words come to mind when you think of our brand?" can uncover priceless insights you would never find otherwise.

The power of targeted surveys in the UK is clear. A study on B Corp Certification found that public awareness hit 51% , a massive leap from 34% in 2022. They calculated this by combining recall of the B Corp logo with recognition of the term 'B Corp', proving how structured surveys can effectively quantify both types of awareness.

Harnessing Social and Media Listening

Surveys give you answers to your questions. Social listening tells you what people are saying when you are not in the room. This means monitoring conversations across social media, forums and blogs to see what is being said about your brand, your competitors and your industry as a whole.

Tools like Brandwatch or Sprout Social can automate this, letting you track sentiment in real time. Are mentions mostly positive, negative or neutral? A sudden spike in negative comments could be an early warning of a PR problem, giving you a chance to get ahead of it.

Social listening also gives you vital context. Are people raving about your customer service or complaining about a specific product feature? This feedback is raw, honest and incredibly useful for strategic planning.

Media monitoring is similar but focuses on your brand's presence in the press, on news sites and in industry publications. Using tools like Cision or Meltwater , you can track your "share of voice" against competitors. This gives you a solid feel for your authority and visibility in your sector. Analysing this coverage is a must for any real brand health check. For more on this, check out our guide on https://www.superhub.biz/what-is-a-brand-audit-and-why-it-matters.

Combining Methods for a Complete Picture

Neither qualitative nor quantitative methods can tell the whole story alone. The real magic happens when you bring them together.

Imagine Google Analytics shows a drop in direct website traffic (the 'what'), while your social listening tool picks up chatter about customers being confused by a recent rebrand (the 'why').

On their own, these are just isolated data points. Together, they tell a clear story and point you towards a solution. To get a real handle on audience perception, it is worth using a structured qualitative research content analysis to systematically pull out themes and patterns from all that customer feedback.

Mixing the numbers with the narrative is how you move beyond basic tracking. You start to truly understand your brand’s place in the minds of your audience—and that is the foundation of any strategy worth having.

Here is a quick breakdown of how these two metric types stack up against each other.

Quantitative vs Qualitative Brand Awareness Metrics

| Metric Type | What It Measures | Examples | Common Tools |

|---|---|---|---|

| Quantitative | The 'what'—numerical, measurable data. | Direct Traffic, Search Volume, Social Reach & Engagement, Conversion Rates | Google Analytics, SEMrush, Ahrefs, HubSpot |

| Qualitative | The 'why'—context, sentiment and perception. | Survey Responses (open-ended), Social Media Mentions, Media Coverage, Focus Group Feedback | SurveyMonkey, Typeform, Brandwatch, Cision |

Ultimately, a balanced approach is key. Use quantitative data to spot trends and identify areas for investigation, then deploy qualitative methods to understand the human behaviour driving those numbers.

Finding Your Starting Point: Baselines and Benchmarks

Tracking metrics is one thing, but making sense of them is another. All the data in the world is just noise until you know what you are measuring against. If you want to see your brand awareness grow, you first have to get a crystal-clear picture of where you stand right now.

This is all about establishing a solid baseline and then setting realistic benchmarks to guide your strategy. It is the difference between guessing and knowing. Think of it like a road trip – you cannot plot a course until you know your current location. This 'before' picture turns raw data into a strategic map, letting you track progress properly and prove the value of your marketing spend.

Running Your Initial Brand Audit

First things first, you need to conduct a full audit of your current brand awareness. This is not just a quick glance at your follower count; it is a deep dive into the metrics we have already covered to create a detailed snapshot of your brand's position in the market today.

Your audit needs to capture a few key data points to form your baseline:

- Website Analytics: Pin down your current monthly direct traffic and branded search volume . This is a hard number showing how many people are already looking for you by name.

- Social Media Presence: Document your current reach , impressions and follower counts across the platforms that matter to your audience. This gives you a baseline for visibility.

- Share of Voice: Get a social listening or media monitoring tool to work out your current share of voice against your top three competitors. This puts your presence into context.

- Recall Surveys: Run an initial brand perception survey. This will give you your starting aided and unaided recall scores, the most direct measure of your mental market share.

Once you have these figures, you have got your baseline. These are the numbers you will come back to time and again to see if your campaigns are actually moving the needle.

Sizing Up the Competition and the Industry

With your own numbers sorted, it is time to look outwards. Your brand does not operate in a bubble, so seeing how you stack up against the competition and the wider industry is essential for setting targets that are ambitious but not delusional.

Start by running the same audit on your closest competitors. Use tools like Semrush to check out their website traffic or Google Trends to compare their branded search volume with yours. This analysis will quickly show you where you are leading and, more importantly, where you are lagging behind.

Setting goals without understanding the competitive landscape is a recipe for disappointment. Knowing what 'good' looks like in your sector turns arbitrary numbers into meaningful targets.

A new automotive tech startup in the UK, for example, cannot realistically expect to match the brand awareness of Ford overnight. It is just not going to happen. But what it can do is analyse the growth of more recent market entrants to set informed, sensible targets for its first year. This research stops you from aiming for the impossible while still pushing for real growth.

Setting Targets That Stretch but Do Not Break

Now you are ready to set your benchmarks. A benchmark is just a specific, measurable target you want to hit within a set timeframe, based directly on your baseline data and competitor research.

Good benchmarks are always SMART: Specific, Measurable, Achievable, Relevant and Time-bound . So, instead of a vague goal like "improve social media presence," a SMART benchmark would be: "Increase our share of voice on LinkedIn from 15% to 25% within the next quarter."

Aided brand recognition is a brilliant metric for this, especially in competitive UK sectors. A Statista survey on smart home brands found that Samsung achieved 93% awareness, LG hit 90% and Dyson reached 87% when people were shown their logos or names. This kind of data shows just how powerful visual cues are and provides a solid standard for brands who want to play at the top level.

By auditing your current position, researching the field and setting clear targets, you build a proper framework for growth. Your efforts are no longer just hopeful shots in the dark; they become focused, strategic and, most importantly, measurable.

Building a Sustainable Brand Tracking System

Measuring your brand's health is not a one-off job you can just tick off a list. It is an ongoing process that keeps your finger on the pulse of your market. Sporadic checks only give you isolated snapshots, but a continuous tracking system gives you the whole film, revealing the trends, the momentum and the real story of how you are perceived.

The aim here is to build an efficient, sustainable system that slots right into your marketing strategy, rather than feeling like another chore.

By getting into a consistent rhythm of tracking, you will be the first to spot shifts in perception, react to what your competitors are doing and make agile tweaks to your strategy. It is about proactively managing your brand’s health, not just putting out fires after they have already started.

Creating a Central Marketing Dashboard

First things first: consolidation. All that juicy quantitative data—website traffic, search volume, social reach—is probably scattered all over the place. A central marketing dashboard pulls it all together, giving you a single, clear view of your brand’s performance at a glance.

Tools like Google Data Studio or the built-in dashboards in platforms like HubSpot are brilliant for this. They can pull data from Google Analytics, your social media accounts and SEO tools into one customisable screen. Think of the hours you will save by not having to jump between a dozen tabs just to compile a simple report.

Your dashboard should be built to spotlight the KPIs you have already decided are important. For instance, you could create widgets showing:

- Month-on-month direct traffic growth to see if brand recall is heading up or down.

- Branded search volume measured against your top three competitors.

- Social media share of voice to track how visible you are in the conversations that matter.

Implementing a Survey Cadence

While a dashboard has your numbers covered, you need a similar routine for your qualitative insights. This is where brand perception surveys come in. Running them on a consistent schedule—quarterly is a great place to start—is the key to gathering reliable feedback over time.

This regular cadence lets you track changes in aided and unaided recall, monitor any shifts in brand sentiment and check if your messaging is actually hitting home. Consistency is everything; use the same core questions each time so you know you are comparing like for like.

To make this manageable, create a survey template you can quickly roll out each quarter. This streamlines the whole thing, turning it into a routine task instead of a massive project that everyone dreads.

Building a brand tracking system is really about creating habits. When checking your brand dashboard becomes as routine as checking your email, you have successfully embedded measurement into your company culture.

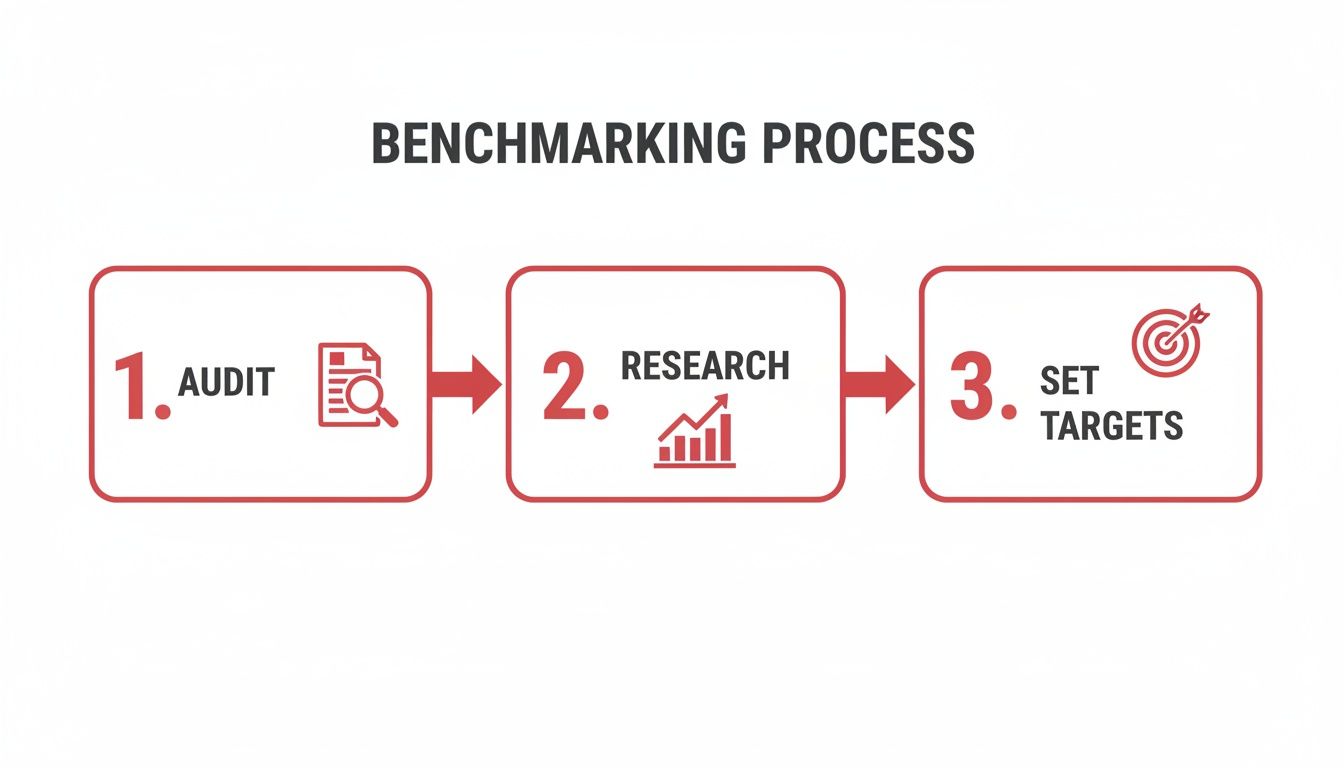

This simple, repeatable process for setting your benchmarks is the foundation of any solid tracking system.

It all starts with an internal audit, flows into external research and finishes with setting clear, data-informed targets for your system to track against.

Brand strength metrics are a powerful way to see the impact of this continuous effort. Take the Brand Finance UK 250 report: Dettol earned the top AAA+ rating for its strength, while Utility Warehouse doubled its value to £364.4 million on the back of 24% annual customer growth, proving the direct link between awareness and expansion.

By building a system like this, you turn measurement from a headache into a real strategic advantage. For more on this, check out our guide on mastering marketing performance metrics.

Your Top Brand Awareness Questions, Answered

Jumping from the theory of brand measurement into the practical, day-to-day work can bring up a lot of questions. It is one thing to know what to measure, but another to figure out the how and when.

This is where things get real. We have gathered some of the most common questions we get from UK businesses to give you direct, practical answers that will help you move forward with confidence.

How Often Should We Be Measuring Brand Health?

There is no single magic number here. The right rhythm really depends on your business's pace and the market you are in. That said, a great rule of thumb is to run a deep-dive brand perception survey at least once a year . This gives you a solid annual benchmark to measure against.

For more immediate feedback, especially around campaigns, aim for quarterly check-ins on your core metrics. This is frequent enough to spot trends and see the impact of your marketing without drowning your team in data.

Think about your own situation:

- High-Growth Startups: If you are running campaigns thick and fast to grab a foothold, you need to be agile. Quarterly, or even bimonthly, tracking is essential.

- Established Brands: For more stable businesses, a comprehensive annual audit, supported by quarterly reviews of your quantitative data on a dashboard, is usually enough.

- After a Major Campaign: Always, always plan to measure your brand health about 4–6 weeks after a big campaign wraps up. This is the sweet spot for assessing its direct impact.

What Are the Most Cost-Effective Tools for a Small Business?

You absolutely do not need an enterprise-level budget to measure brand awareness well. Many of the most powerful tools are either free or surprisingly affordable, making them perfect for small to medium-sized businesses.

You can build a seriously effective toolkit with just a few key players:

- Google Analytics & Search Console: Both are completely free and non-negotiable for tracking direct traffic and branded search queries.

- Google Trends: Another free gem. It is brilliant for seeing how your branded search volume stacks up against competitors over time.

- AnswerThePublic: A fantastic free resource for digging into the actual questions people are asking around your brand and your industry.

- Low-Cost Survey Platforms: Tools like SurveyMonkey or Typeform have free or affordable plans that are perfect for running smaller-scale brand perception surveys.

- Affordable Social Listening: You do not need to spring for the most expensive tools. Platforms like Hootsuite or Buffer have built-in analytics that offer great insights into your reach and mentions.

You can build a surprisingly robust brand tracking system for less than £100 a month . The secret is not spending a fortune on software; it is about being consistent with the right mix of free and low-cost tools to get the data you need.

How Do You Separate Brand Awareness and Lead Generation Metrics?

This is a critical distinction, and getting it wrong can lead you to completely misjudge your marketing success. Put simply, brand awareness is about reach and recognition , while lead generation is about immediate action .

Think of them as two different, but connected, stages of the customer journey.

Brand Awareness Metrics Focus On:

- Mental Availability: Are we the first name people think of? (Measured by unaided/aided recall, share of voice).

- Reach & Visibility: How many people are seeing our stuff? (Measured by social reach, impressions, search volume).

- Familiarity: Do people know who we are and come to us directly? (Measured by direct traffic).

Lead Generation Metrics Focus On:

- Action & Intent: Are people taking the next step? (Measured by form fills, demo requests, downloads).

- Conversion: How many of those people become genuine leads? (Measured by conversion rates).

- Cost-Effectiveness: How much are we paying to get each lead? (Measured by cost per lead).

A brilliant content campaign might get a massive spike in social reach and shares—a huge win for brand awareness—but generate very few direct leads. That does not make it a failure. It just means its primary job was building visibility, not driving instant conversions. Understanding this difference is vital for accurately judging your marketing ROI.

At Superhub , we specialise in turning brand awareness from a fuzzy idea into a measurable engine for growth. If you are ready to build a powerful brand strategy that is backed by solid data, our team is here to help.

Find out how we can help at https://www.superhub.biz.

Want This Done For You?

SuperHub helps UK brands with video, content, SEO and social media that actually drives revenue. No vanity metrics. No bullshit.